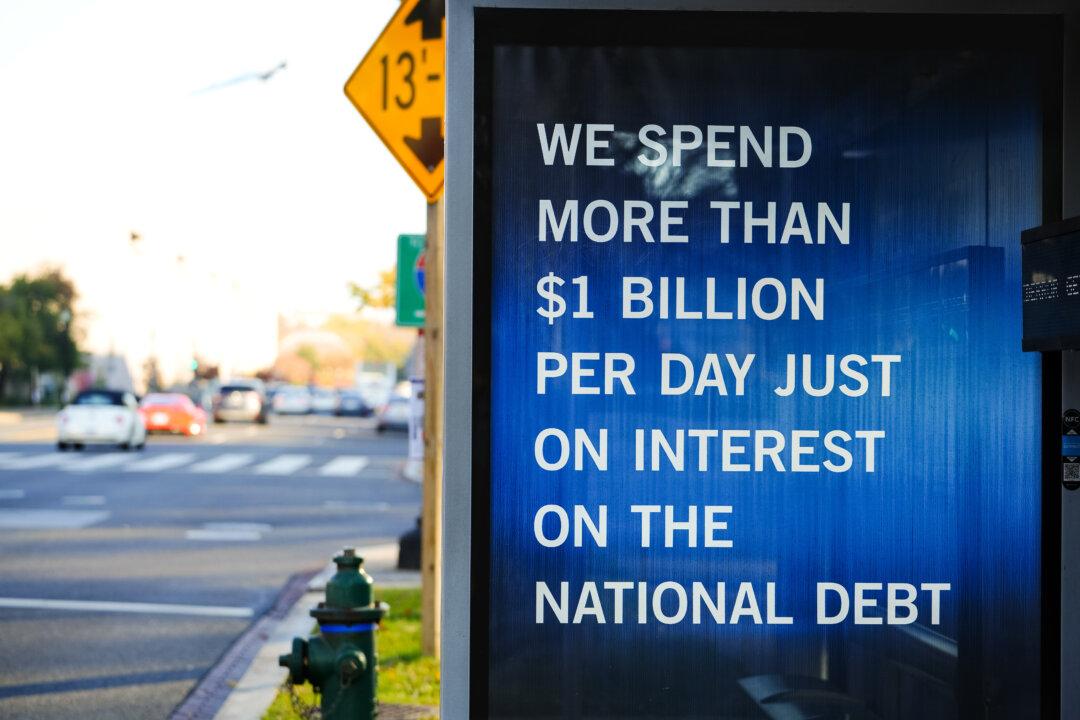

Nearly half of individual income tax revenues in fiscal year 2024 were dedicated to paying interest on the national debt, new Treasury Department data show.

According to the Final Monthly Treasury Statement, the federal government registered the third-highest budget deficit in the nation’s history, exceeding $1.83 trillion for fiscal year 2024, an increase of 8 percent from fiscal year 2023.