The U.S. debt ceiling is a relic from another time that serves no useful purpose and should be abolished, according to 43 House Democrats, an opinion shared by some leading economists.

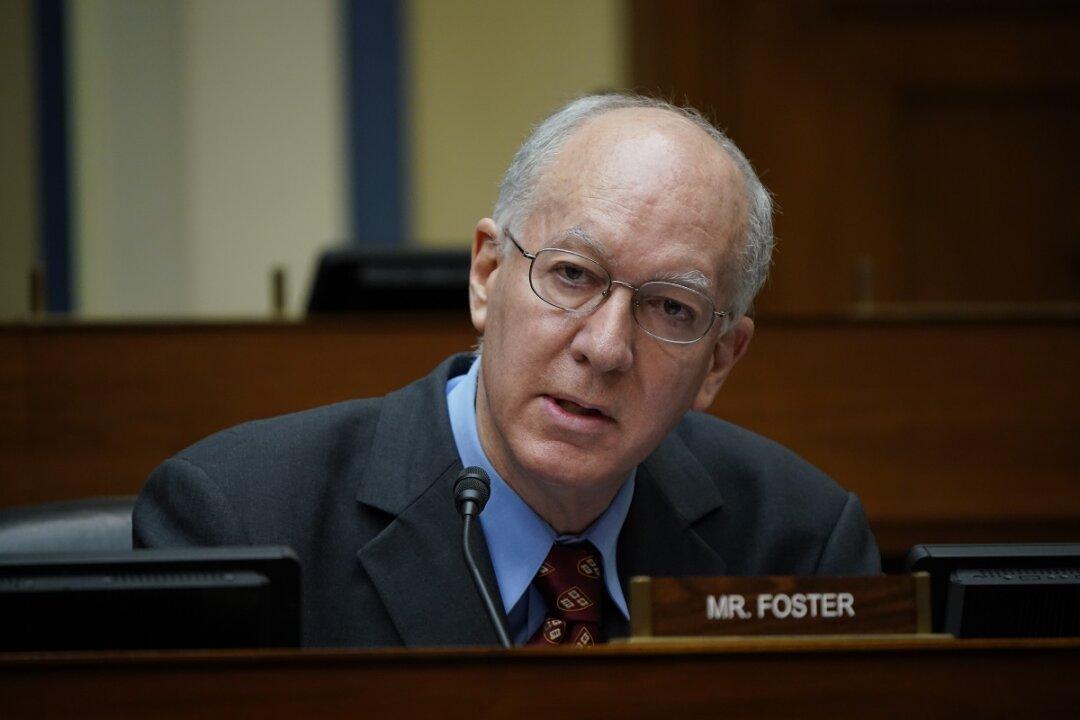

The effort to abolish the ceiling is led by Rep. Bill Foster (D-Ill.), who introduced H.R. 415, the End the Threat of Default Act, which would repeal the debt ceiling to prevent it from being used to wield political leverage.