Sloan said that legislators’ push for green energies to try and encourage the market to go to a place where it’s not ready to go is naturally inefficient.

The top-line price of the bill’s climate policies is around $369 billion.

The Inflation Reduction Act emphasizes tax incentives for companies and individuals who switch to renewable energy sources.

For instance, the bill would dole out as much as $28,500 in tax incentives to American households who buy more energy-efficient electric home appliances, install solar panels on their homes, and buy new electric vehicles. Though families would need to do all these to reach that $28,500 figure, it represents one of the largest government climate incentives ever for individual households.

Sloan called the legislative move a “political decision.”

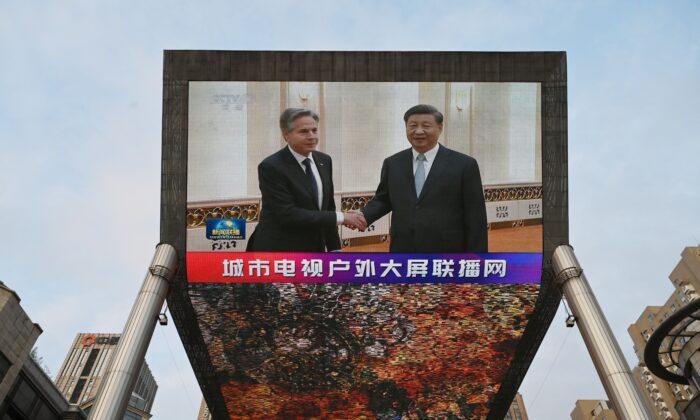

China Benefits

According to the expert, the green bill pursues two-tier goals: incentivize demand and domestic production.“The issue with incentivizing domestic production, domestic manufacturing, is that that’s a very long-term play. And that’s going to take decades, not months or years, to bring in,” he said.

“So if you’re going to incentivize green technologies, you necessarily have to include China because they are the ones that predominate,” he added.

China remains the world’s biggest supplier of the components and materials required for renewable energy technologies.

Silicon is a key ingredient in solar panels, and in 2021, China accounted for 75 percent of global photovoltaic (PV) module production, according to statistics.

Fuel Prices Increase

Sloan predicted that if the United States keeps going down the path of scaling back on domestic production of traditional energy, that is, fossil fuels and nuclear power, Americans will see an increase in fuel prices.“If among the jumble of legislation is some political will to increase our use of nuclear, increase our use of fossil fuels, and smartly increase our use of renewables, that can mitigate that load. But if we allow China to do the same thing that OPEC did in the 1970s with oil, if we’re not trying to do the same thing today with some of these critical raw materials to capitalize it, and we don’t have any alternatives, then we can definitely see rising consumer prices, simply from that side as well,” he said.

“I think it’s a little bit of a detriment to the U.S. if we are pursuing policies that mandate more solar panels,” he added.

To prove this point, he pointed to what happened in Europe during the Ukraine war.

“We’ve seen in Europe after the Russian invasion of Ukraine and natural gas supplies from Russia to Europe being essentially cut off, that Europe had to adjust its energy policy to be more realistic just to keep the lights on. They’ve kept nuclear plants online, they’ve opened up coal plants again, and they’re looking around the world for new sources of, particularly, natural gas for electricity,” he said, adding that the U.S. should do that.

He said it is a small step but “maybe a sign that the administration is looking around and seeing that their energy policy does have to, at the end of the day, keep the lights on and keep people moving.”