The U.S. economy does not need any more digital currencies, according to Gary Gensler, the Securities and Exchange Commission (SEC) chief.

Appearing on CNBC’s “Squawk on the Street” on June 6, Gensler asserted that cryptocurrency and virtual tokens are unnecessary in today’s economic landscape.

“Look, we don’t need more digital currency,” he told the business news network. “We already have digital currency. It’s called the U.S. dollar. It’s called the euro, or it’s called the yen; they’re all digital right now. We already have digital investments.”

As the digital revolution has seeped into the global economy, various financial and payment systems have gone digital.

Meanwhile, there are approximately 25,000 cryptocurrencies today.

In recent days, Gensler has targeted some of the world’s largest crypto exchanges.

“These trading platforms, they call themselves exchanges, are commingling a number of functions,” Gensler added. “We don’t see the New York Stock Exchange operating a hedge fund.”

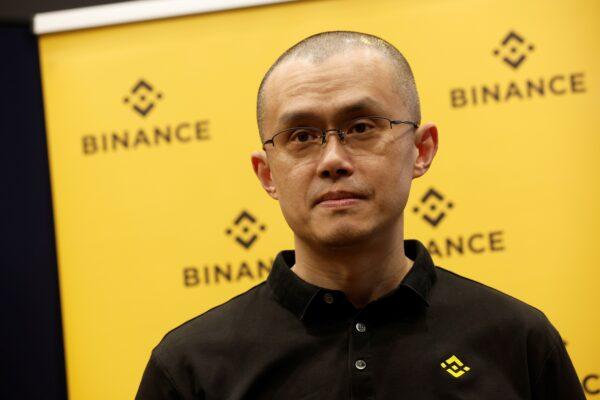

The U.S. financial watchdog sued crypto exchange Binance and its founder Changpeng Zhao on June 5, filing 13 charges. The SEC alleged that Binance commingled billions of dollars in user funds and transferred the funds to a European firm controlled by Zhao.

The lawsuit occurred soon after the Commodity Futures Trading Commission (CFTC) filed charges against the crypto exchange, accusing Binance of violating federal law to attract U.S. users and subverting the organization’s “ineffective compliance program.”

Following the news, Binance expressed disappointment in the SEC and its complaint in a blog post.

“From the start, we have actively cooperated with the SEC’s investigations and have worked hard to answer their questions and address their concerns,” the company wrote. “Most recently, we have engaged in extensive good-faith discussions to reach a negotiated settlement to resolve their investigations. But despite our efforts, with its complaint today the SEC abandoned that process and instead chose to act unilaterally and litigate. We are disheartened by that choice.”

A day later, SEC sued Coinbase in New York federal court, alleging that the company was functioning as an exchange and an unregistered broker, requesting that the website be “permanently restrained and enjoined” from continuing to operate in this manner.

“We allege that Coinbase, despite being subject to the securities laws, commingled and unlawfully offered exchange, broker-dealer, and clearinghouse functions,” Gensler said in a statement.

The Digitization of the Dollar

The U.S. dollar has yet to be digitized by the federal government or the Federal Reserve.During an interview with “60 Minutes” in May 2020, Federal Reserve chair Jerome Powell explained that the central bank creates money digitally and produces physical currency. However, this does not mean that a digital dollar is presently making its way through the national or global economy. But this is in the beginning stage.

Over the past year, the Federal Reserve has been studying, exploring, and testing a central bank digital currency, also known as a CBDC.

In November 2022, the Federal Bank of New York launched a 12-week pilot project with several major financial institutions. The purpose was to test the use of a digital dollar, with these virtual tokens acting as customers’ deposits. Officials noted that the aim was to determine how the tokens are settled through the central bank utilizing a ledger shared with these banks.

CBDC proponents contend that this technology can speed up payments, reduce the costs of digital payments, offer alternative options, and help the 4.5 percent of unbanked households participate in the financial system.

But critics fear the federal government could use a CBDC as a surveillance tool.

“The consequences, if we get it wrong, are far too serious,” House majority whip Tom Emmer (R-Minn.) said at a news conference in February. “The Biden administration is currently itching to create a digital authoritarian-style, surveillance-style digital dollar through an executive order.”

There also have been concerns surrounding the institution’s instant payments network known as FedNow. The initiative would facilitate real-time transactions, letting companies and individual clients of participating banks send and receive payments 24/7. This would provide customers with immediate access to funds. The current system does not process payments on weekends.

But while some have argued that this was the start of introducing a digital dollar into the financial system, the Fed assured the public that this has nothing to do with a CBDC.

“FedNow is not related to a digital currency. FedNow is a payments service the Federal Reserve is making available for banks and credit unions to transfer funds. It is like other Federal Reserve payments services, such as Fedwire and FedACH. The FedNow Service is neither a form of currency nor a step toward eliminating any form of payment, including cash,” the central bank stated in April.

“The Federal Reserve has made no decision on issuing a central bank digital currency (CBDC) and would only proceed with the issuance of a CBDC with an authorizing law.”

Fed governor Michelle Bowman suggested in an April speech that the success of FedNow might make a digital dollar redundant.

The program is scheduled for launch in July.

Marshall Billingslea, a senior fellow at the Hudson Institute, also told a June 7 hearing of the House Subcommittee on National Security, Illicit Finance, and International Financial Institutions that it is unlikely that the U.S. government would construct a digital dollar soon.

“I also have some doubts that if we can’t even get a website for healthcare functioning, I’m not exactly sure that we can build a digital dollar in any meaningful timeframe under the Federal Reserve,” he said.