Capitalism for most people means people and corporations make the most money they can and accumulate as much wealth as they can.

This is wrong, at least according to the Austrian school of economics taught and practiced at the beginning of the last century by Carl Menger and Ludwig von Mises in Vienna, Austria—hence, the name. And that idea of capitalism was even mainstream up until the 1950s.

Today few universities teach it and neoclassical economics, monetarism, and Keynesianism take precedence in practice.

Correctly understood, saving, as well as correctly understood consumption, are oriented toward life.

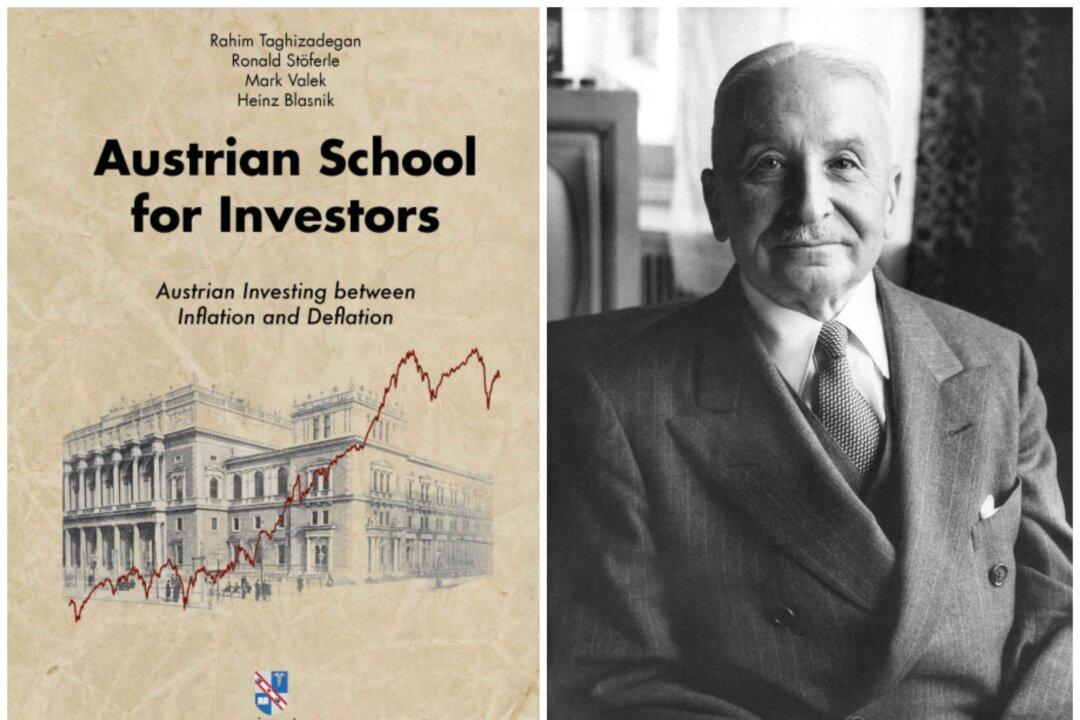

— From 'Austrian School for Investors'