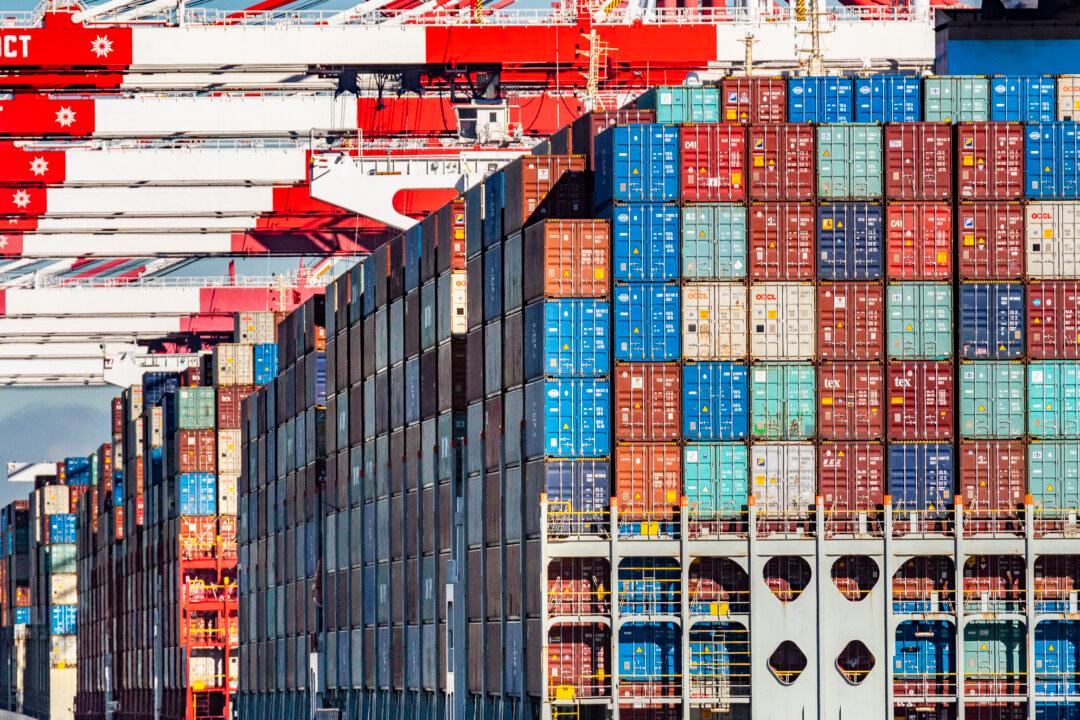

Some oranges and grapefruit are rotting in containers as the ongoing supply chain crisis at U.S. ports delays citrus exports for two weeks or more in some locations.

Since December 2021, Johnston Farms in Bakersfield, Calif., has dealt with shipping delays and equipment shortages. Some of their grapefruit have been found spoiled upon delivery.