WASHINGTON—President Donald Trump announced on June 14 a finalized rule that could benefit employees without employer-sponsored health care and potentially help small businesses contribute to their employees’ health care without having to offer them a plan.

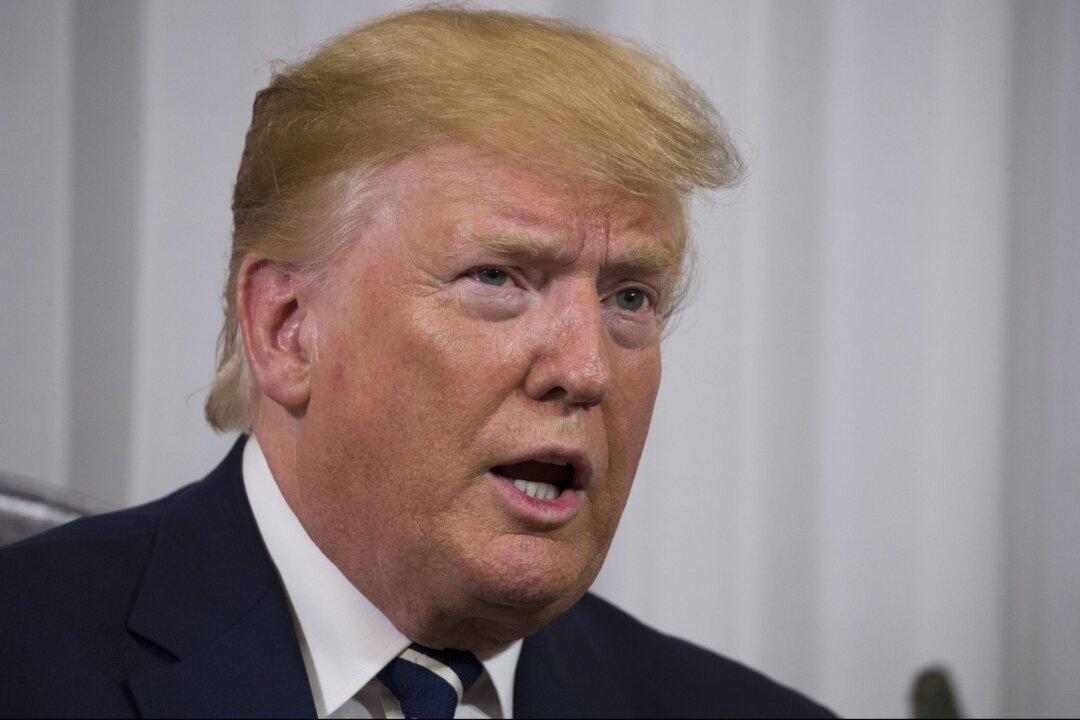

President Donald Trump speaks before a meeting with Irish Prime Minister Leo Varadkar, at the Shannon Airport in Shannon, Ireland on June 5, 2019. Alex Brandon/AP Photo

Holly Kellum

Washington Correspondent

|Updated: