Beth Ann Bovino, the head U.S. economist for S&P Global Ratings, said that the chance of a recession hitting the United States is increasing.

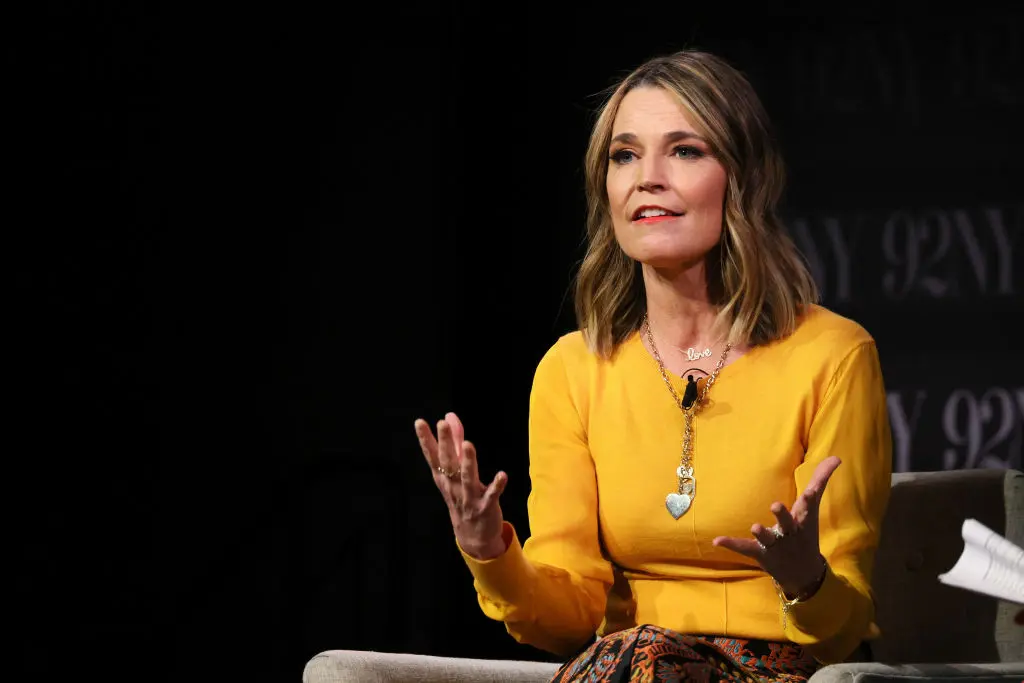

When asked during a Yahoo Finance panel about the prospects of a recession occurring, she said that American households, including individuals who are lower-income, “are still sitting on a nice bit of savings.”