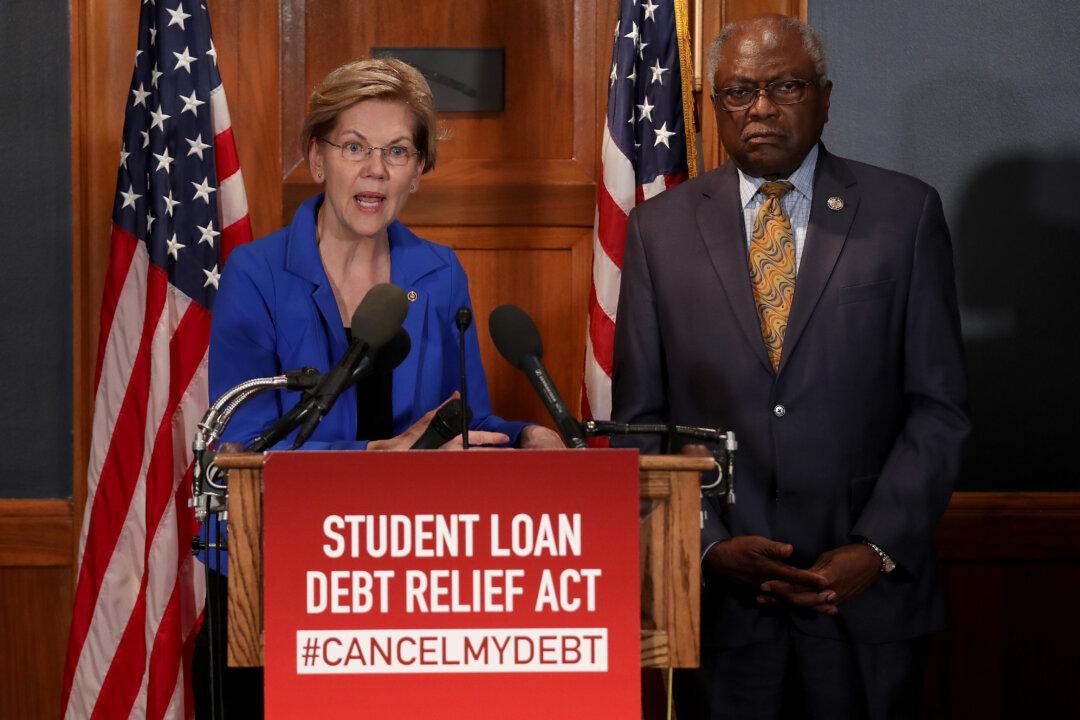

WASHINGTON—Sen. Elizabeth Warren (D-Mass.) would end the college loan “crisis” by forgiving $1.25 trillion in such debt and then making college tuition-free, but a new study casts doubt that such a program is even needed.

Warren claims that the crisis is so great that it’s “crushing millions of families and acting as an anchor on our economy. It’s reducing home ownership rates. It’s leading fewer people to start businesses. It’s forcing students to drop out of school before getting a degree. It’s a problem for all of us.”