Commentary

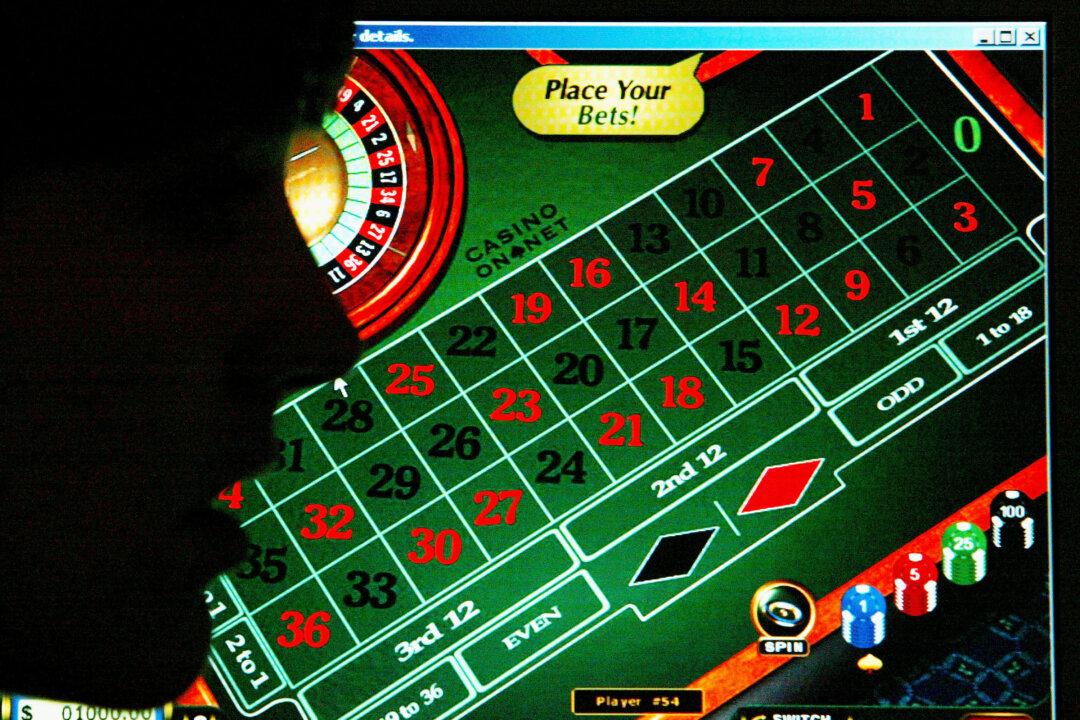

Any resident of Ontario who spends time watching YouTube videos, at least the ones I watch, would have noticed an explosion of ads for online gambling websites that offer the chance to enjoy the casino experience on your smartphone, tablet, or laptop.