Commentary

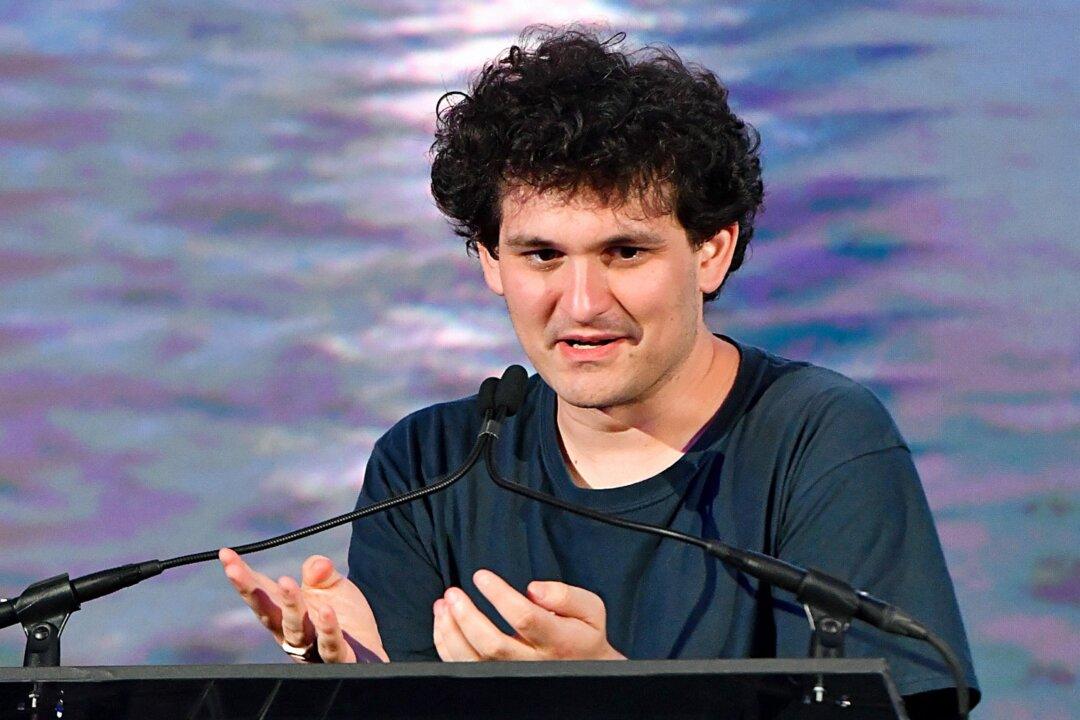

One has to appreciate Sam Bankman-Fried’s honesty of late. After running FTX, a presumed $32 billion company, to zero in a matter of days, he took to Twitter to reveal what many of us already knew. He said that “woke” is a racket.

One has to appreciate Sam Bankman-Fried’s honesty of late. After running FTX, a presumed $32 billion company, to zero in a matter of days, he took to Twitter to reveal what many of us already knew. He said that “woke” is a racket.