Taxing home equity would bring disastrous political consequences for the party in power, the CEO of the Canadian Real Estate Association (CREA) told the Senate finance committee on Dec. 6.

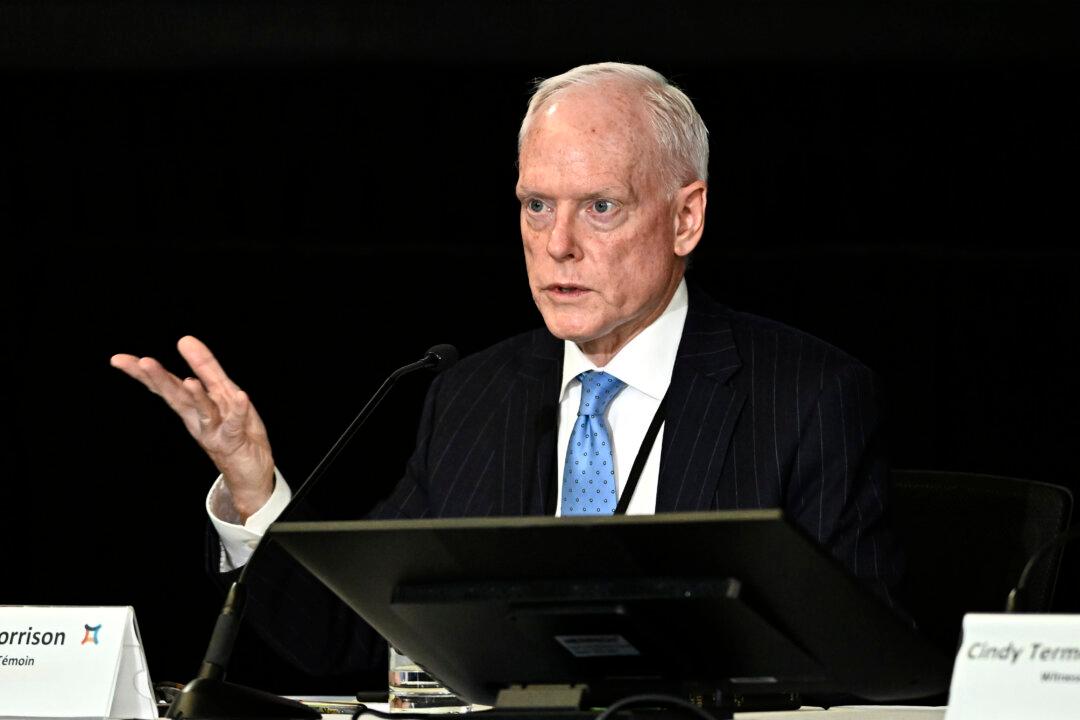

“It would be political suicide for anyone to suggest this,” said CREA CEO Michael Bourque, according to Blacklock’s Reporter.