Commentary

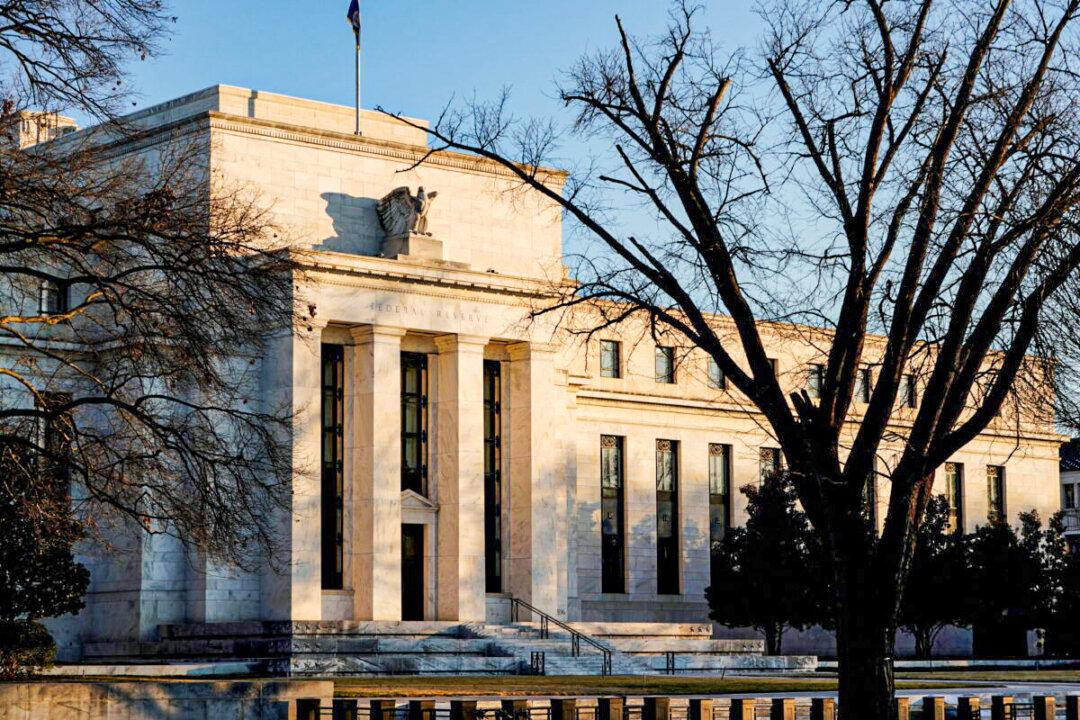

On Sept. 22, Federal Reserve Chair Jerome Powell suggested during the Federal Open Market Committee (FOMC) press conference that the FOMC board was very close to tapering its purchases of Treasury and mortgage-backed securities. Initially, bond prices rallied on the news, then were slammed lower over the following two days as investors changed their view on how a balance sheet taper might affect bond prices.