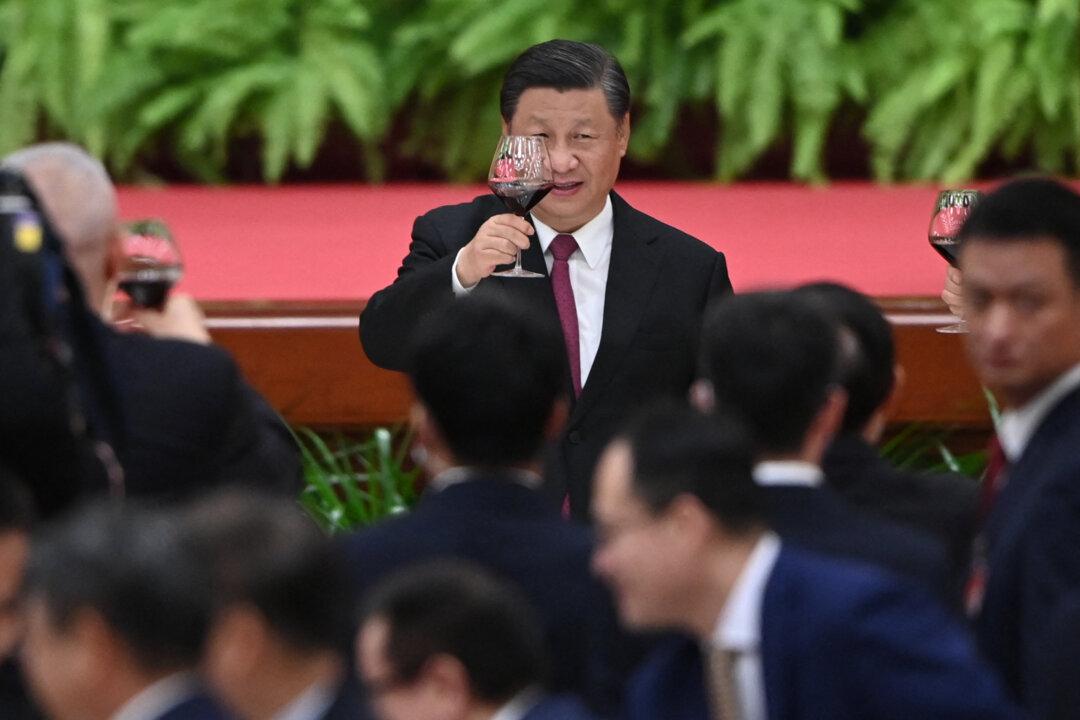

China’s Long March Through the Microchip Industry

China’s infringement of U.S. intellectual property (IP) rights is one of the main disputes underlying the Sino-U.S. trade war. And disputes over microchip technology are some of the most common in the IP battle.China has been researching and developing microchips for over half a century. At present, however, the “sore spot” of the microchip still exists, and the root of this sore spot is precisely the state-run system that China is so proud of in its high tech research and development. This type of system concentrates and directs all of the nation’s forces in technological research, by which the government takes the lead in coordinating organizations, assigning tasks, providing funds, and pursuing breakthroughs. Leaving aside production costs, gains made are first applied to the military, because the military only wants products that are usable, and the government pays all the bills anyway. Meanwhile in the civilian sector, high-cost technology developed through domestic researches is not as cost-effective or reliable compared with purchasing foreign technology.