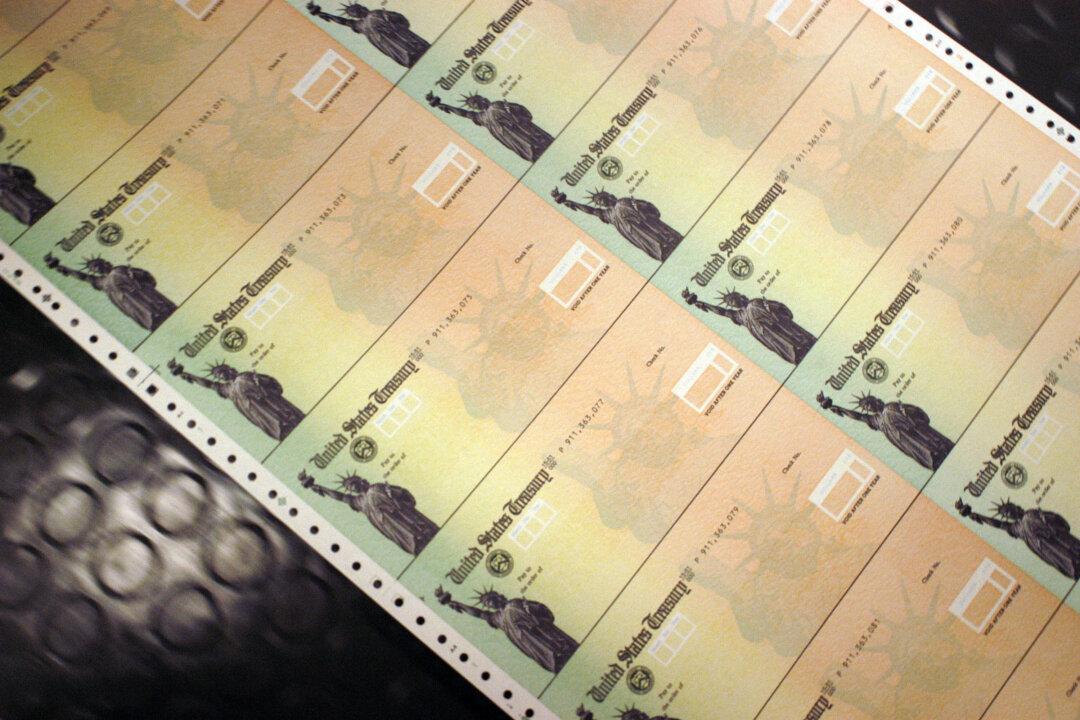

A new report indicates that the Social Security program is expected to run out of money by 2033 due to slower-than-predicted economic growth.

A Social Security and Medicare Trustees report released March 31 found the entitlement program could face insolvency a year earlier than previously reported, in part, due to a revision of gross domestic product and labor productivity over the coming years. Those benefits, which go to retired workers by in large, impact about 50 million people per month, with recipients getting an average payment of about $1,800, according to the Social Security Administration.