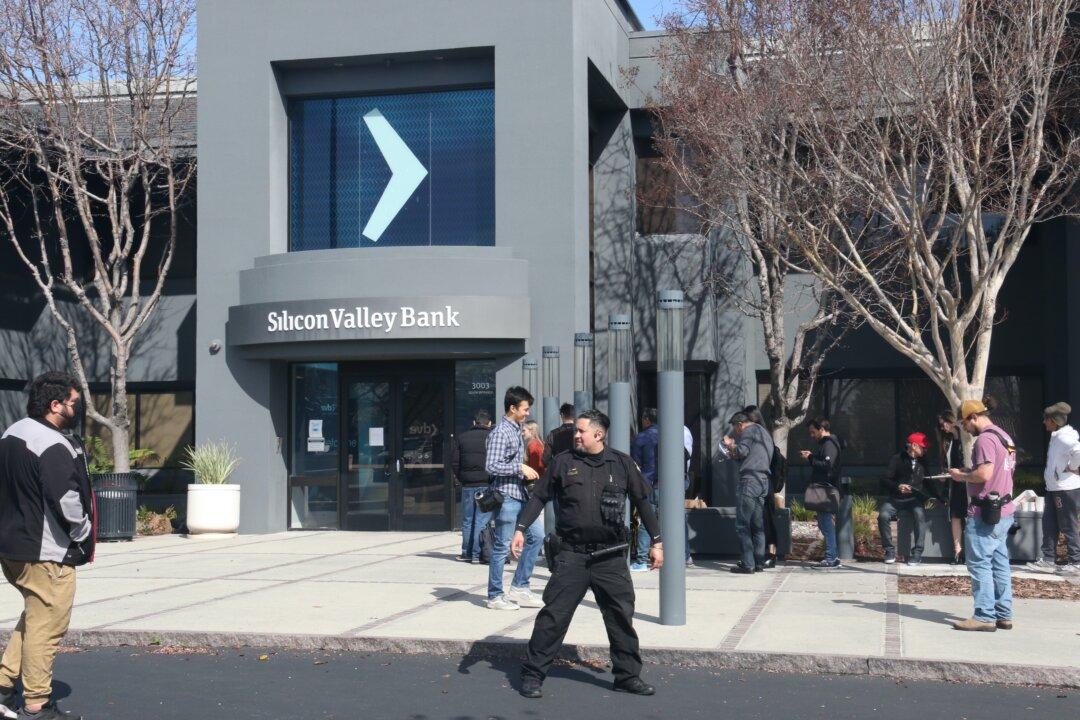

Two months after the collapse of Silicon Valley Bank (SVB), triggered by a social media-fuelled panic, banking executives across America are reevaluating their approach to online platforms. The crisis sparked a broad recognition of the impact of social media on the financial industry, prompting a renewed focus on risk management and mitigation.

An array of strategies are now under development in boardrooms nationwide. These measures are designed to combat potential online threats such as unfounded rumors about a bank’s financial health, which could trigger large-scale deposit withdrawals or negatively impact share prices. This insight comes from several banking industry executives and analysts, who suggest that these previously unreported efforts represent an urgent, adaptive response to the rapidly changing digital environment.