Commentary

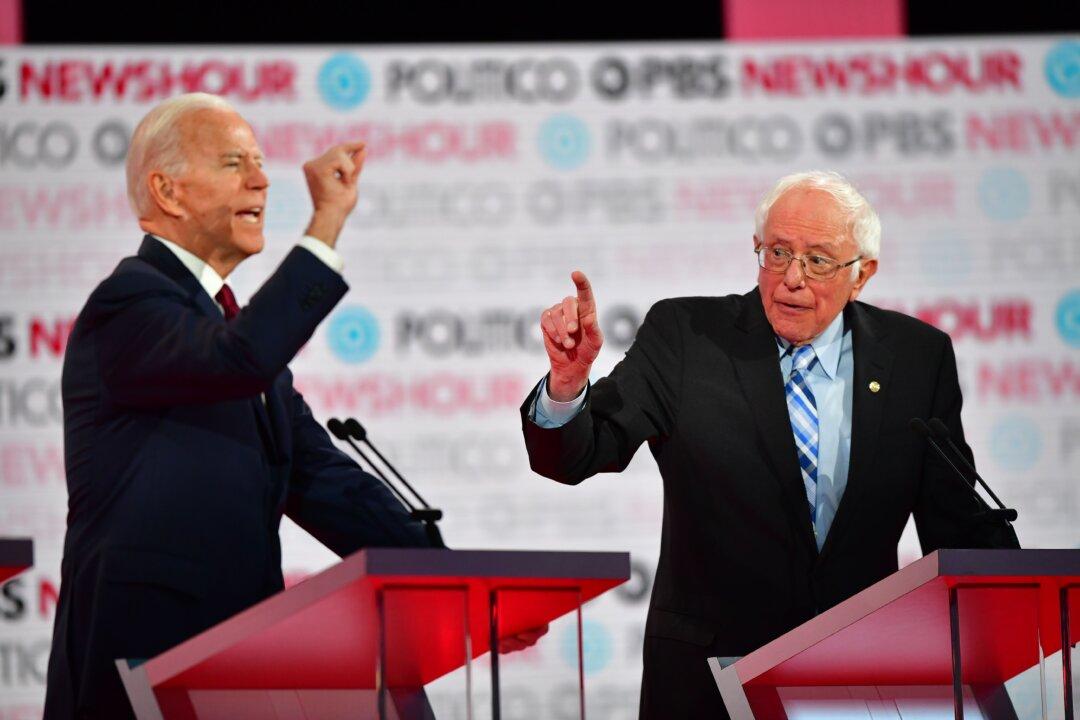

At the outset of the Joe Biden presidency, I warned that we were about to endure yet another Democratic “presidency that seeks to defy the laws of economics—and with that, Americans will suffer.” Six months into the Biden presidency, Americans are suffering terrible results that foreshadow real dangers ahead.