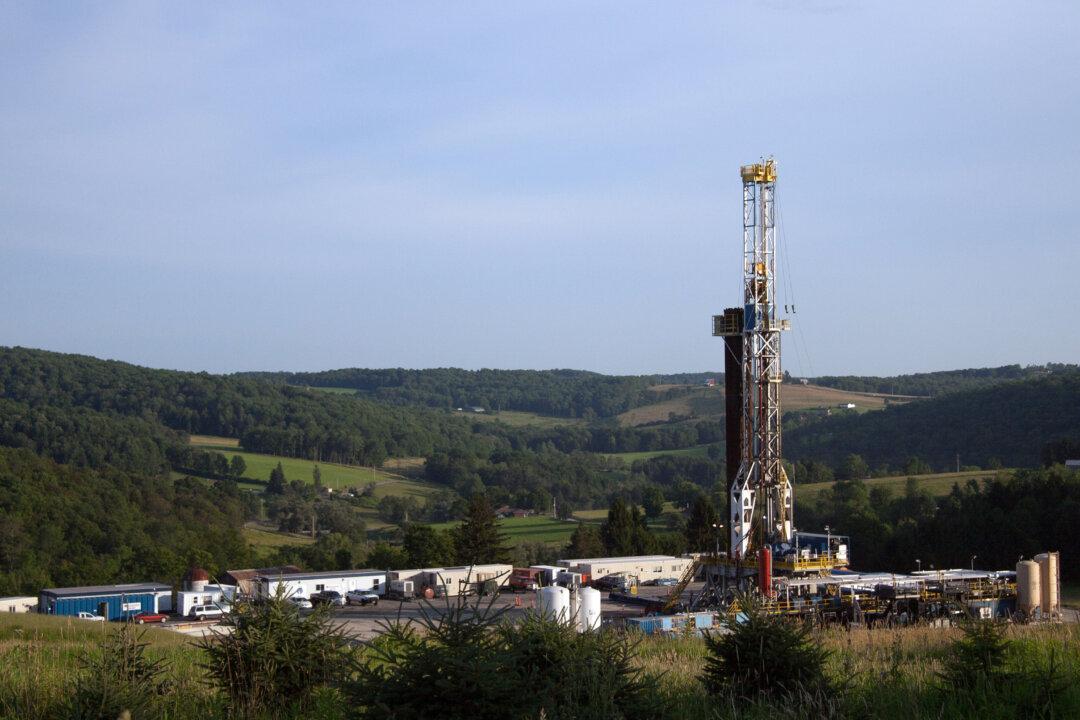

Demand for hydrofracking equipment has been quickly outpacing supply lately, causing a serious parts shortage that is beginning to hamper the expansion of U.S. oil and gas production.

Halliburton Company warned in July that “supply chain bottlenecks, even for diesel fleets, make it almost impossible to add incremental capacity this year.”