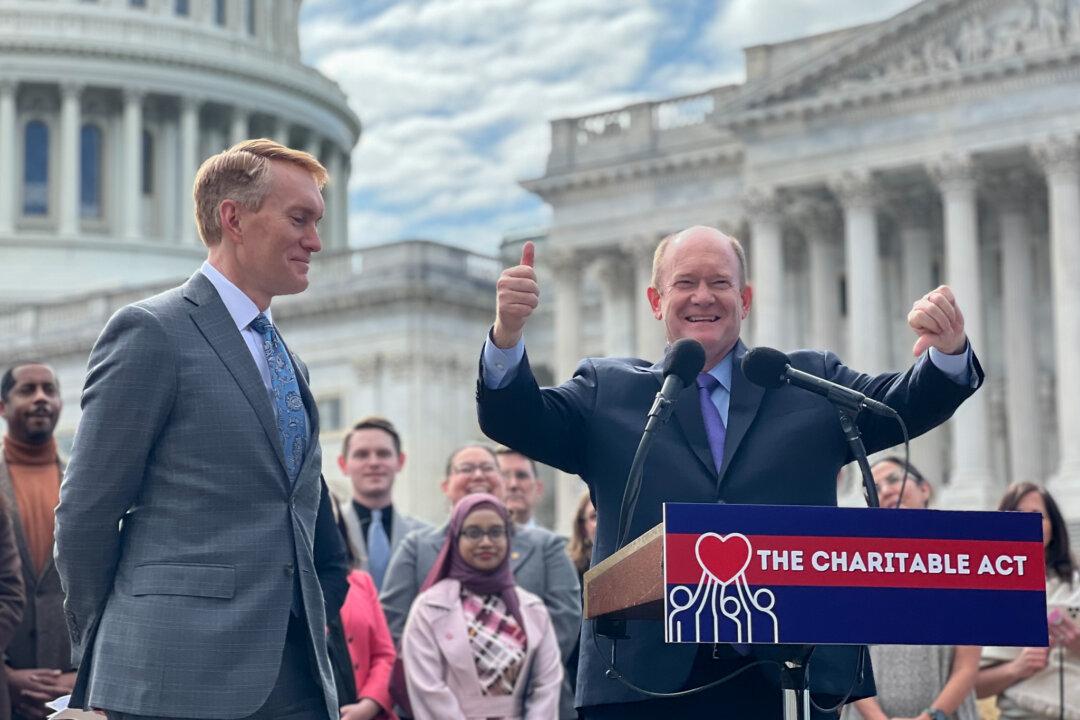

WASHINGTON—Senators James Lankford (R-Okla.) and Chris Coons (D-Del.) announced on March 1 on Capitol Hill a new bipartisan charitable legislation incentivizing taxpayers to donate more by increasing tax deductions.

The bill would provide taxpayers who do not itemize their tax returns with a reduced deduction for charitable contributions on federal income taxes worth up to one-third of the standard deduction—approximately $4,500 for an individual filer and nearly $9,000 for married joint filers.