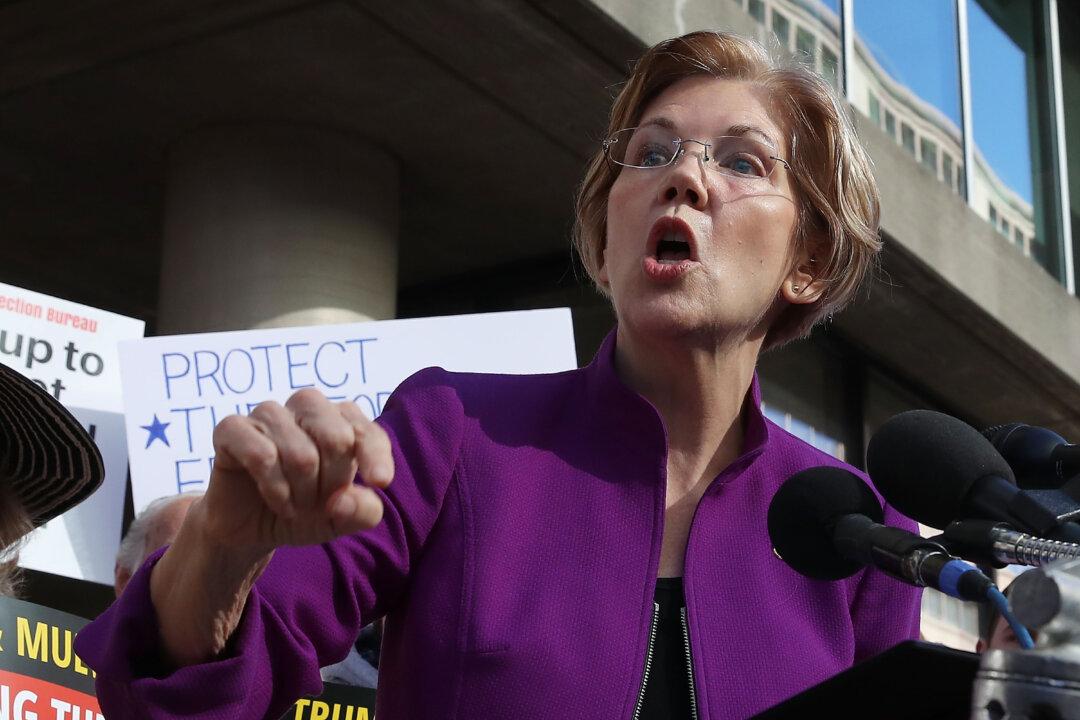

In a letter (pdf) to the Securities and Exchange Commission (SEC) on Friday morning, Sen. Elizabeth Warren (D-Mass.) questioned price swings on stocks like GameStop, AMC, and others and asked for the agency to address “any systemic concerns for financial systems.”

“Casino-like swings in stock prices of GameStop reflect wild levels of speculation that don’t help GameStop’s workers or customers and could lead to market instability. Today I told the SEC to explain what exactly it’s doing to prevent market manipulation,” Warren wrote on Twitter.