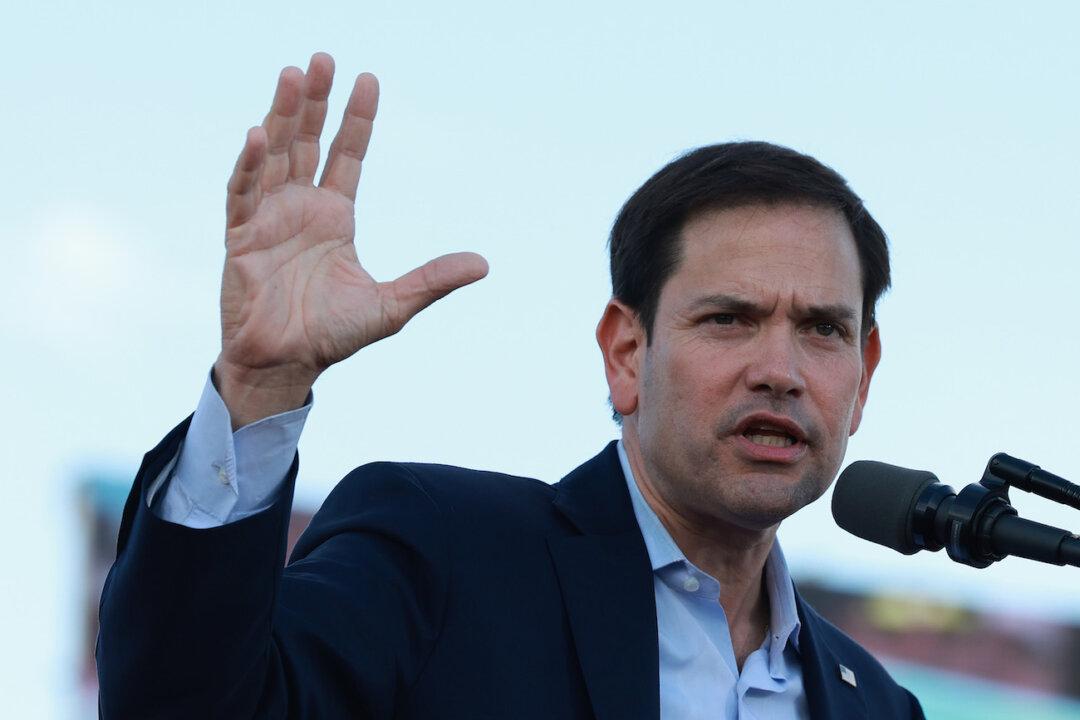

U.S. Sen. Marco Rubio (R-Fla.), the top Republican on the Senate Intelligence Committee, introduced a bill on March 9 that would block U.S. subsidies to Chinese battery companies.

If enacted, Ford’s new electric vehicle battery plant that licenses a Chinese battery maker’s technology wouldn’t qualify for electric vehicle (EV) tax credits appropriated in the Inflation Reduction Act (IRA).