WASHINGTON—During Sen. Kent Conrad’s (D-N.D.) Dec. 12 farewell speech on the Senate floor, he told a story about an event in 1964, when he was just 16 years old.

Conrad went to Washington, D.C., sat in the Senate gallery, and watched a debate on civil rights, led by Hubert Humphrey. Young Conrad was inspired by what he heard and saw that day. He knew that he would one day like to debate the great issues of the day. He returned home and wrote a note to himself to run for the Senate in about 20 years, in either 1986 or 1988. Indeed, he ran in 1986 and scored what Conrad said was the “biggest political upset in the history of our State.”

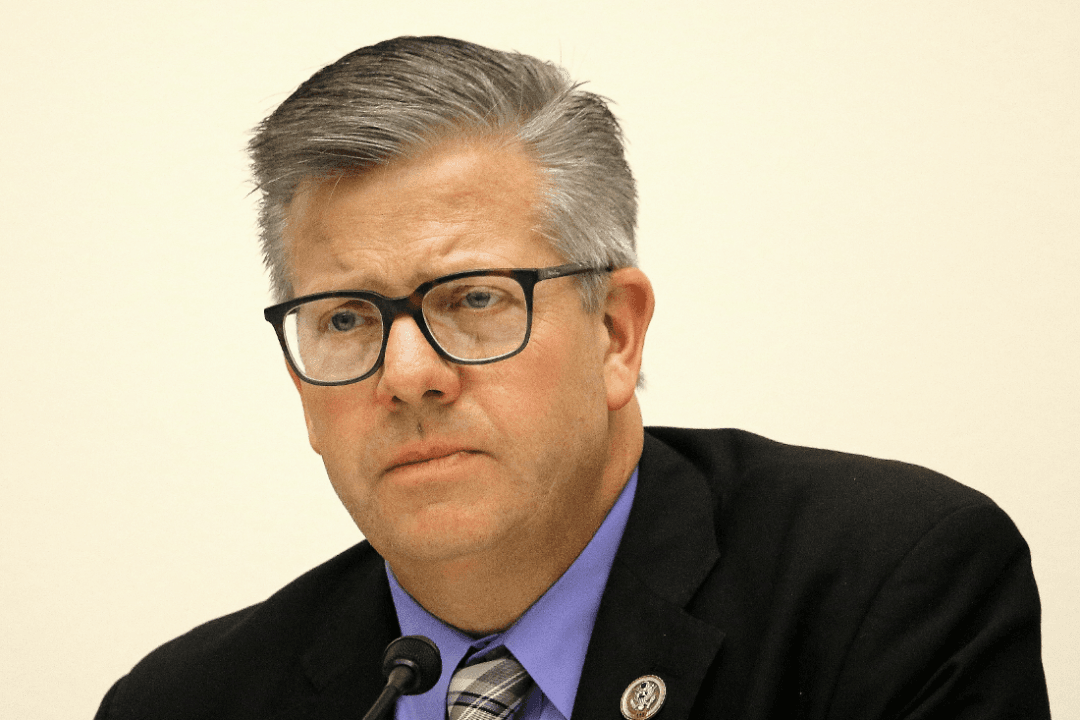

Conrad, a fifth-generation North Dakotan, is retiring this session after serving 26 years in the U.S. Senate.

One week after his farewell speech, Conrad, 64 and chair of the Senate Budget Committee, spoke at the National Press Club Newsmaker on his perspective of the so-called “fiscal cliff.”

Known as a “fiscal hawk,” Conrad brought with him several graphs and charts, making a compelling case for why we need higher tax rates for the wealthy along with substantial spending cuts. The latter is out of step with some of his Democratic Senate colleagues, but Conrad believes that we need these cuts to get the country back on solid fiscal footing.

Conrad was one of six senators appointed to the 2010 National Commission on Fiscal Responsibility and Reform, commonly referred to as the Simpson-Bowles commission. The bipartisan commission has often been cited as an example wherein Democrats and Republicans can compromise on the fiscal cliff talks and achieve a balance between revenue and spending.

Conrad voted with the majority for the Simpson-Bowles plan that proposed $4 trillion in deficit reduction. Other bipartisan commissions have come up with approximately the same number, according to Conrad.

“What we need to stabilize the debt and begin to work it down is a package of about $4 trillion in the next 10 years,” Conrad said.

He would have liked to seen a bigger package arise from the ongoing discussions between President Obama and Speaker John Boehner, but if there is any meaningful deficit reduction, an agreement would be “an important step forward,” according to Conrad.

Government Rescue

As a leader in the Senate, Conrad was invited to a meeting in the fall of 2008—the day before the Bush administration announced a takeover of the private insurance company AIG.

Widely criticized by Republicans, the rescue of AIG would ultimately cost $180 billion—“a staggering sum,” Conrad said at his farewell speech. However, Conrad observed that earlier in the week, it was announced that taxpayers are going to reap $22 billion on the transaction.