“Who will lead the world in the 21st century?” is not merely a rhetorical question, it’s a very real and relevant one. Nations make their way through the years and centuries as well or as poor as their leaders can guide them and circumstances allow. Cultural tendencies and political ideologies also figure forcefully in a country’s destiny. Oil-rich, highly educated Venezuela is learning this firsthand.

The reality is that as we approach the third decade of the 21st century, the country best positioned to lead the world is the same one that led the world through the second half of the 20th century: The United States of America.

Better Policies Make Better Countries

This is based on two simple facts: compared to the major powers of the world—China, the European Union (EU), the UK, Japan, and Russia—the United States is damaging itself least with its worst policies and helping itself the most with its good ones.

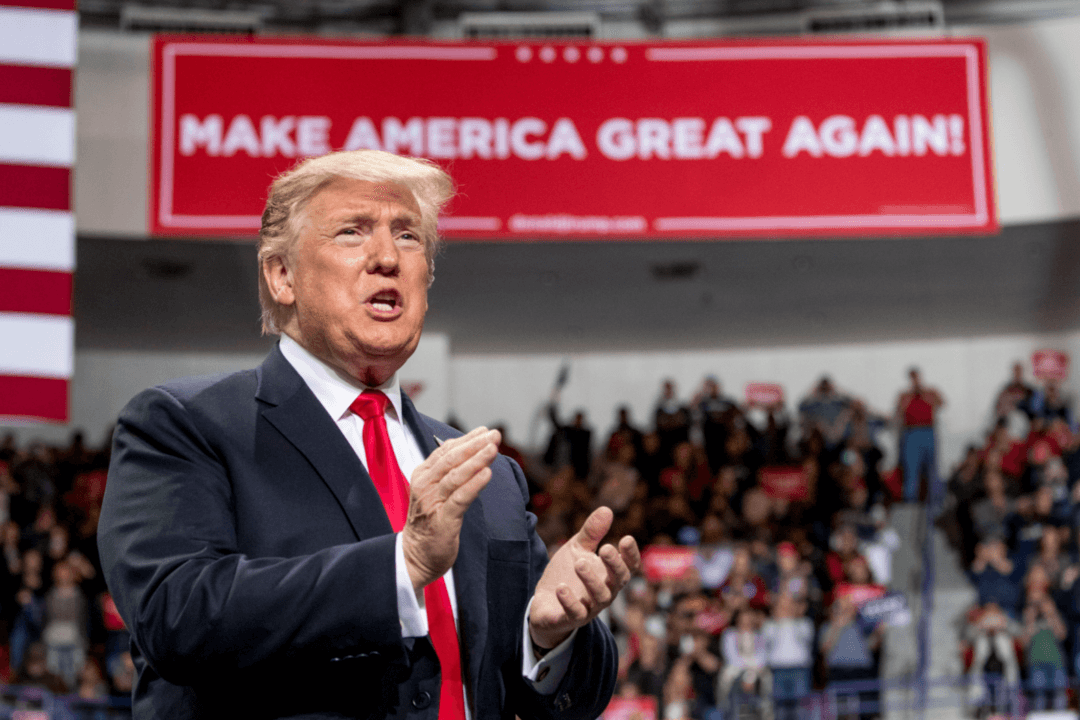

We looked at China last time, so let’s look at the EU, the UK, Japan, and Russia before examining the advantages the Trump administration is creating for the United States.