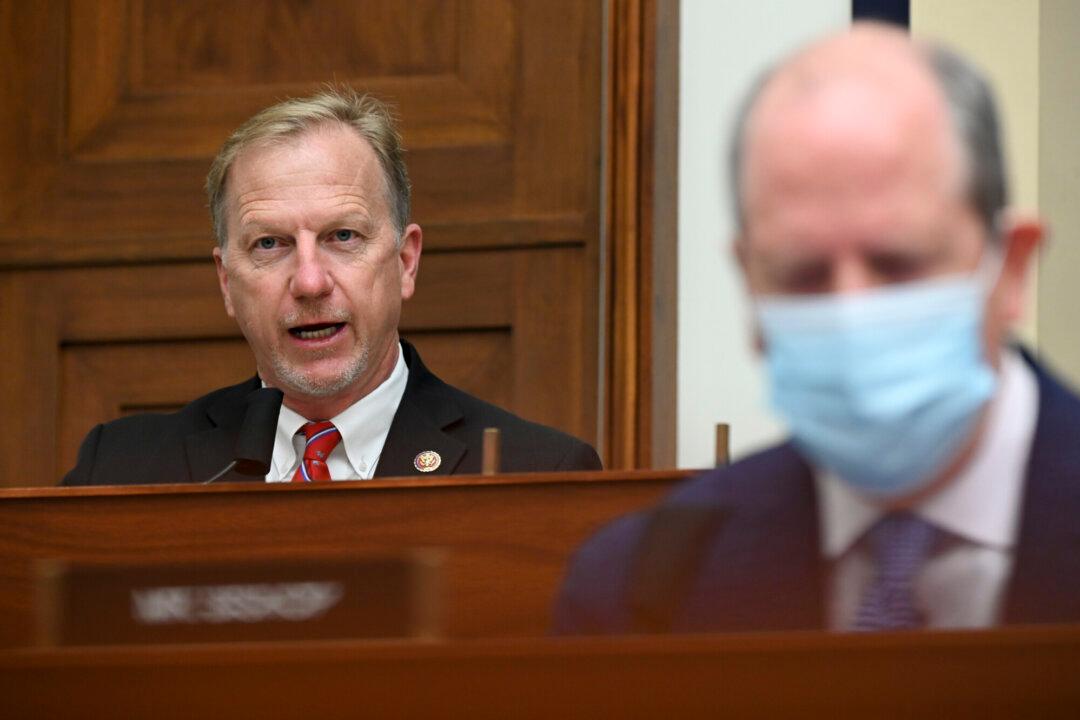

Rep. Kevin Hern (R-Okla.) has outlined the policies Republicans are discussing in connection with debt ceiling negotiations, which include rollbacks on discretionary spending, a cap on future spending, and ‘paid-for’ tax cuts.

Hern, who chairs the House Republican Study Committee (RSC), listed the policy ideas in a letter to committee members on Feb. 1.