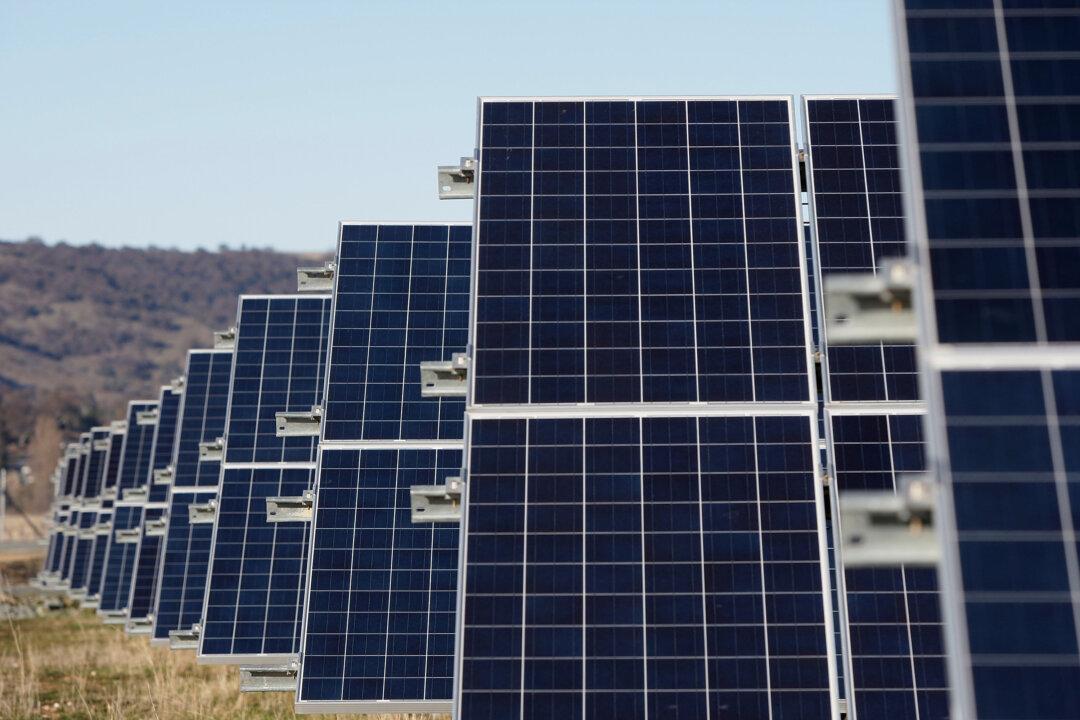

Australians living across the east coast and southern states can expect to see cheaper electricity bills as more wind, solar, and gas generation enter the market.

A report by the Australian Energy Market Commission (AEMC) found that households in the National Electricity Market could expect to pay around $77, or six percent, less for electricity in 2024 than they do now, soothing concerns of price shocks as Liddell coal power station prepares for retirement in 2023.