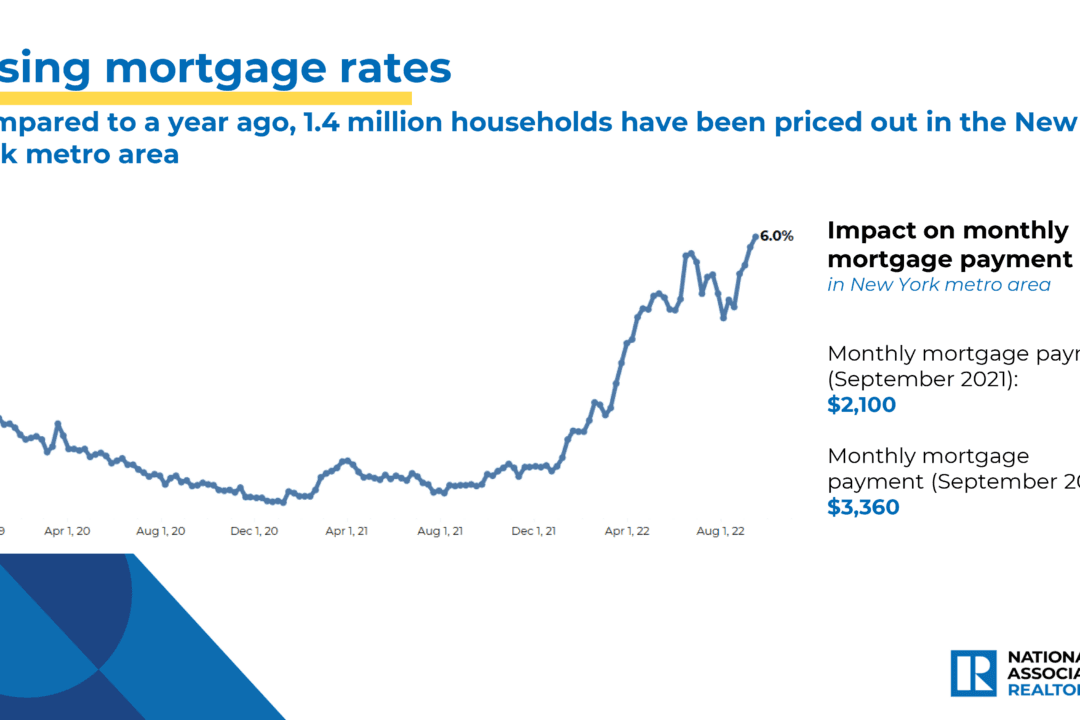

Mortgage rates rose above 7 percent for the first time in more than 20 years, as the American housing market continues to decline.

Prior to March of this year, home-borrowing rates were on the way down after a 40-year low, before the Federal Reserve started to increase interest rates to combat out of control inflation.The last two decades of low interest-rate policies had encouraged growth in the mortgage market, which, excepting the housing crisis in 2007–08, boosted the rate of U.S. homeownership.