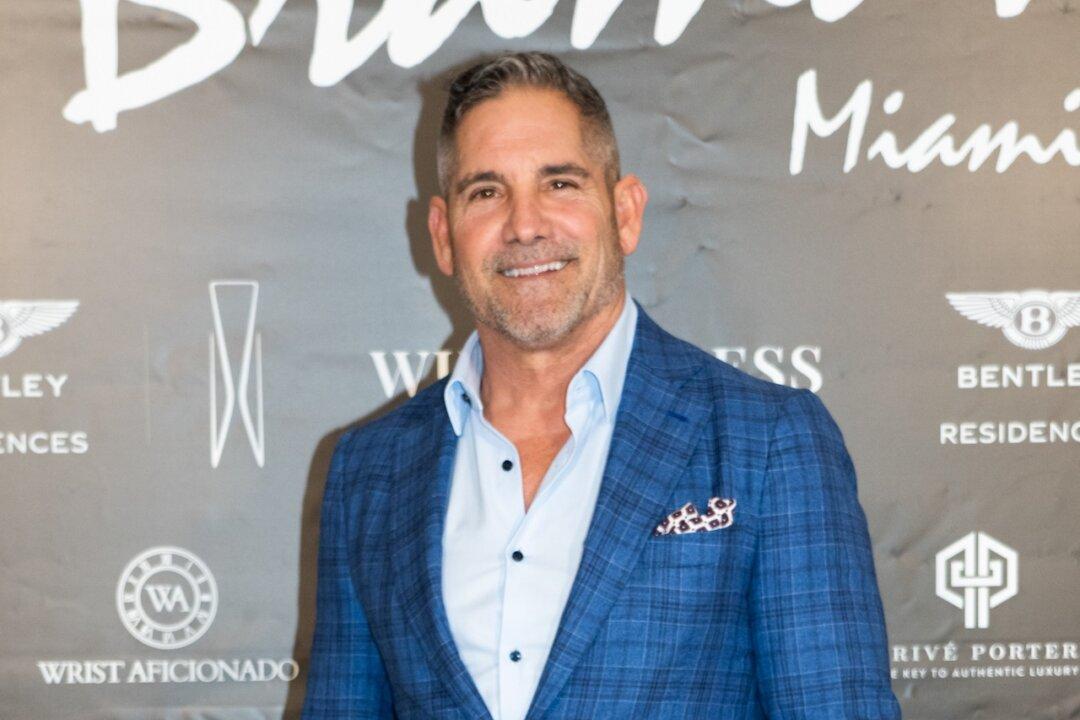

Real estate investor Grant Cardone has said the U.S. Federal Reserve has “single-handedly” crushed the housing market by raising interest rates, causing significant problems for both buyers and sellers in the United States.

Mr. Cardone, a renowned investor and private equity fund manager, said in a “FOX & Friends” interview on Dec. 14 that home-ownership has become unaffordable for many people in the United States today.