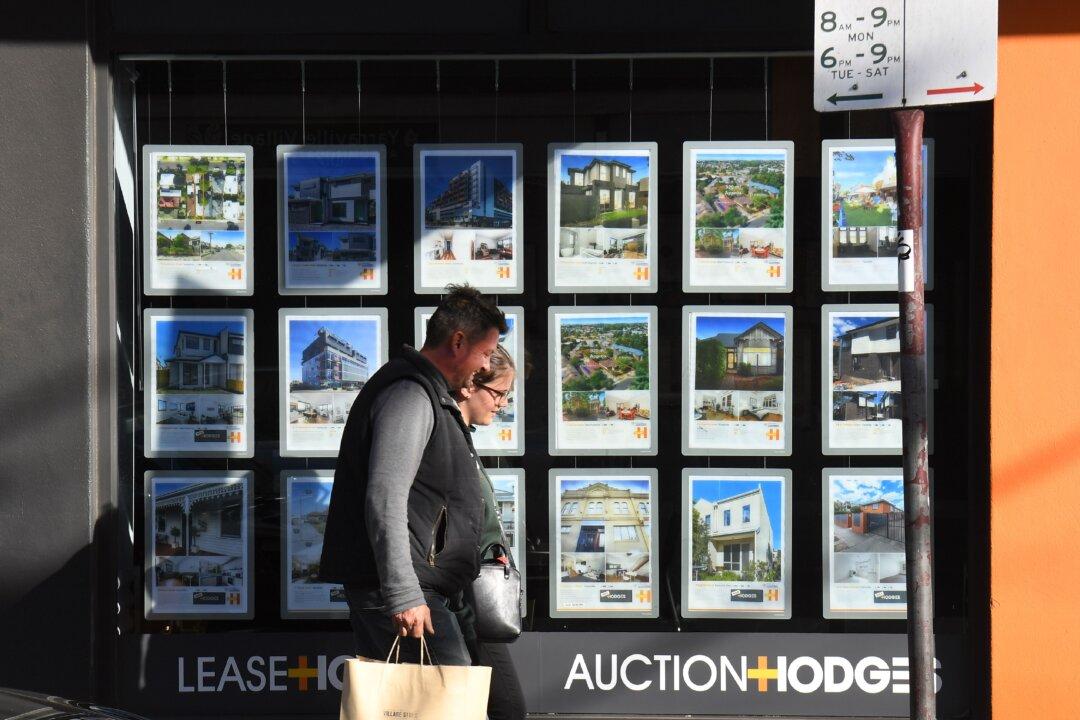

It’s no secret among Americans that many would-be homebuyers have been priced out of the market due to rising mortgage interest rates and persistent inflated listing prices. Some are now considering more affordable options abroad, but experts are warning potential buyers to do their homework before shelling out their savings for the American Dream overseas.

Kathleen Peddicord and her husband Lief Simon, owners of Live and Invest Overseas, noted the biggest surprise for most first-time overseas investors is the transfer tax that most countries impose when buying a property.