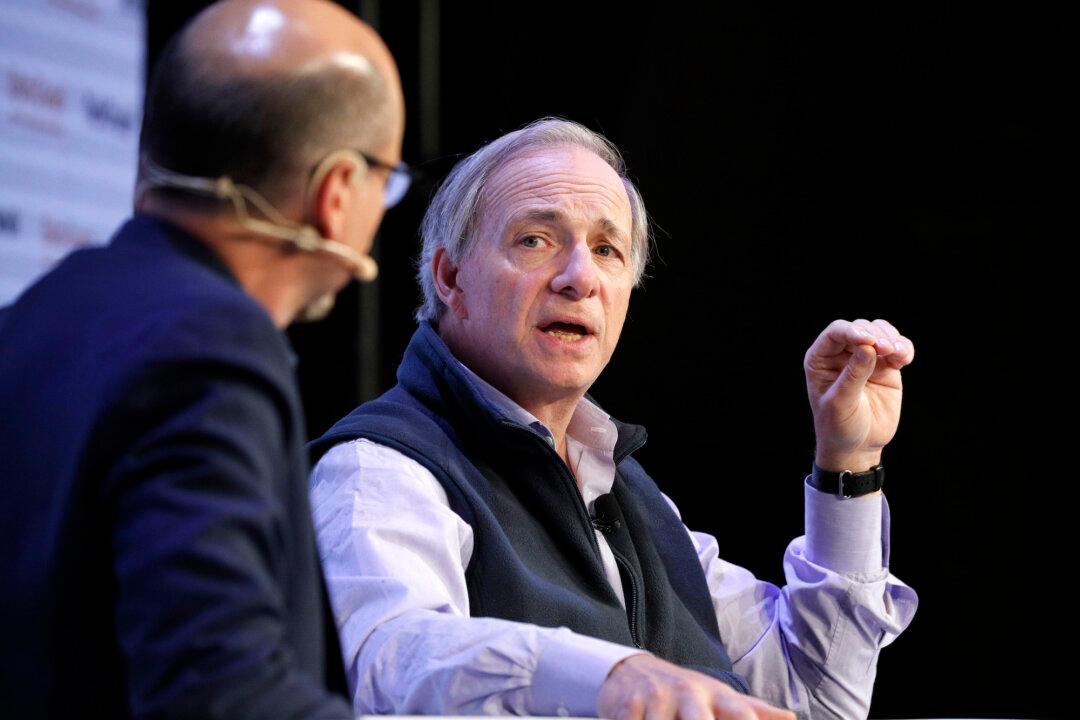

Billionaire investor Ray Dalio said in a note Tuesday that the Fed’s fight to quell soaring inflation would most likely come at the “great cost” of weakening the U.S. economy and stagflation.

Dalio said in his post on LinkedIn that stagflation, which is a combination of sluggish growth and high inflation, is now his base case for the course America’s economy will take as the Federal Reserve tightens monetary settings after years of easy money.