Dear Readers: It’s that time again. And while you may have promised yourself to be smarter about your finances in 2021, we all know that New Year’s resolutions are notoriously ineffective. Despite our best intentions, the vast majority of us simply don’t follow through. So this year, instead of making an overwhelming list of things to do, I’m suggesting that you focus on a few concrete things you need to know. If you educate yourself about your finances, you’ll be laying the foundation for success.

Start the New Year by Raising Your Financial IQ

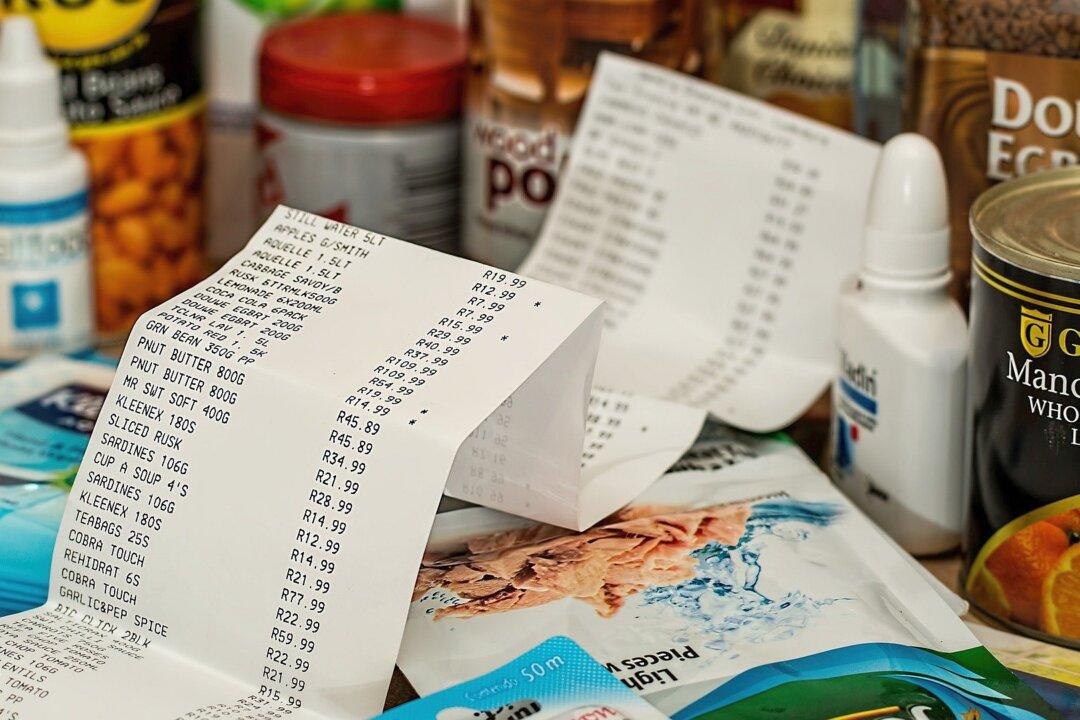

The financial world is filled with numbers and details, many of which you don’t really need to think about. I believe you can give yourself a financial boost for 2021 by just zeroing in on these 10 things—all practical information that only require simple math:• Your net worth. Simply add up your assets and then subtract your liabilities. This will help you plan and prioritize your savings and spending.