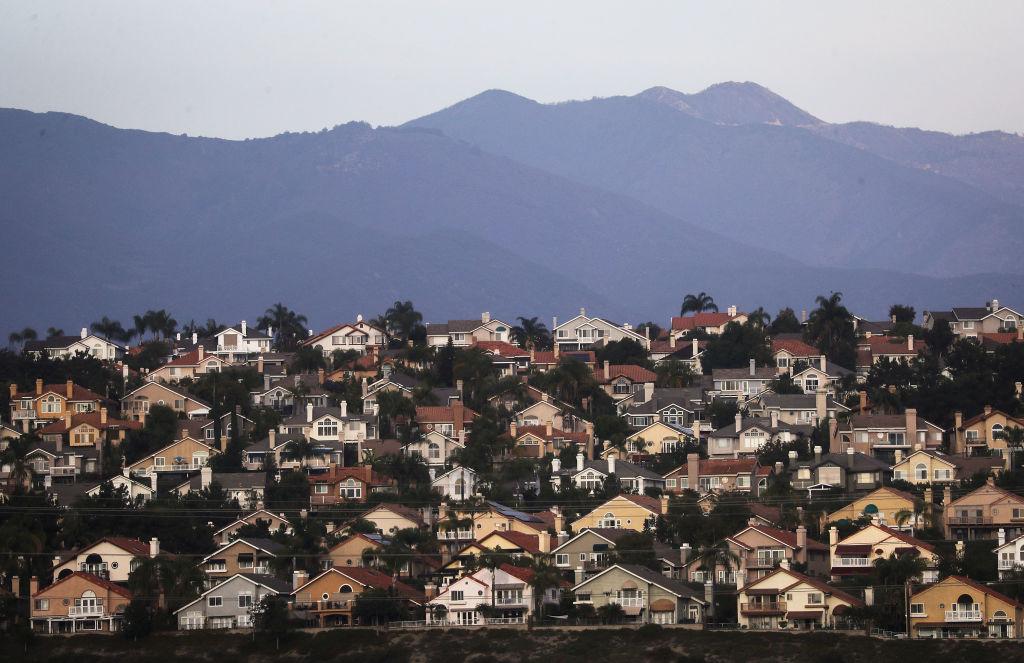

A local state senator is working to delay a recently passed proposition that could cause the taxable value of inherited homes to rise.

Sen. Patricia Bates (R-Laguna Niguel) has introduced a bill that would delay the implementation of a portion of Prop. 19 until February 2023.