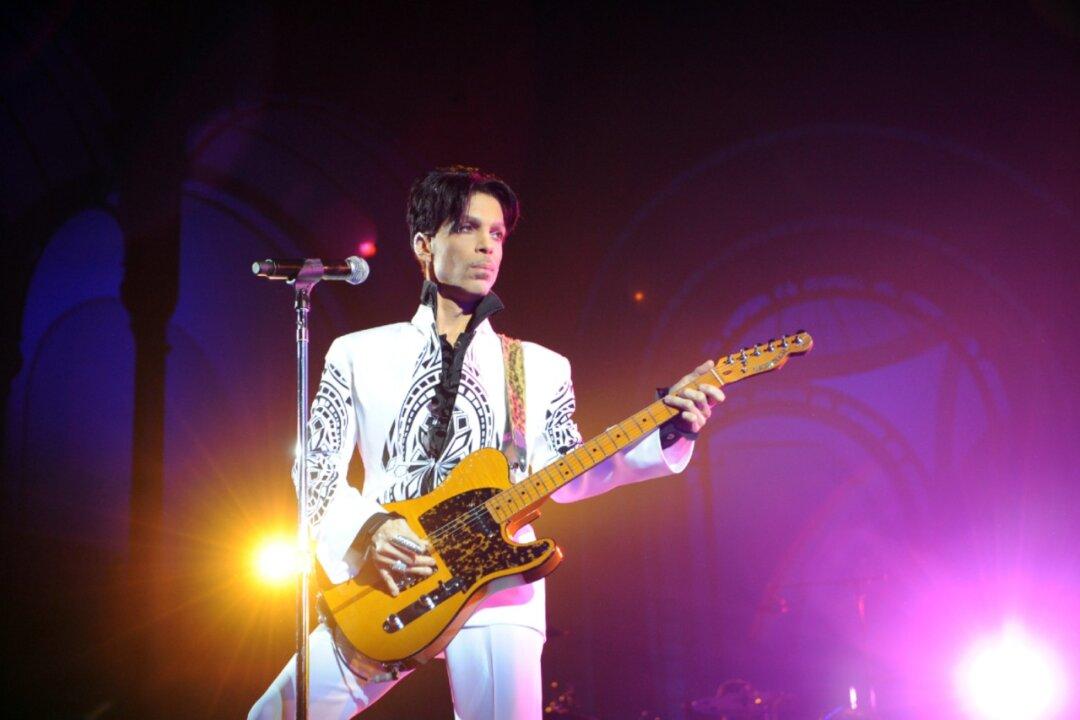

The late singer Prince’s estate has been valued at over $156 million, nearly six years after his death, with the wealth set to be distributed among his family members in February.

The IRS and the estate’s administrator, Comerica Bank and Trust, agreed to value Prince’s estate at $156.4 million, the Minneapolis Star Tribune reported.