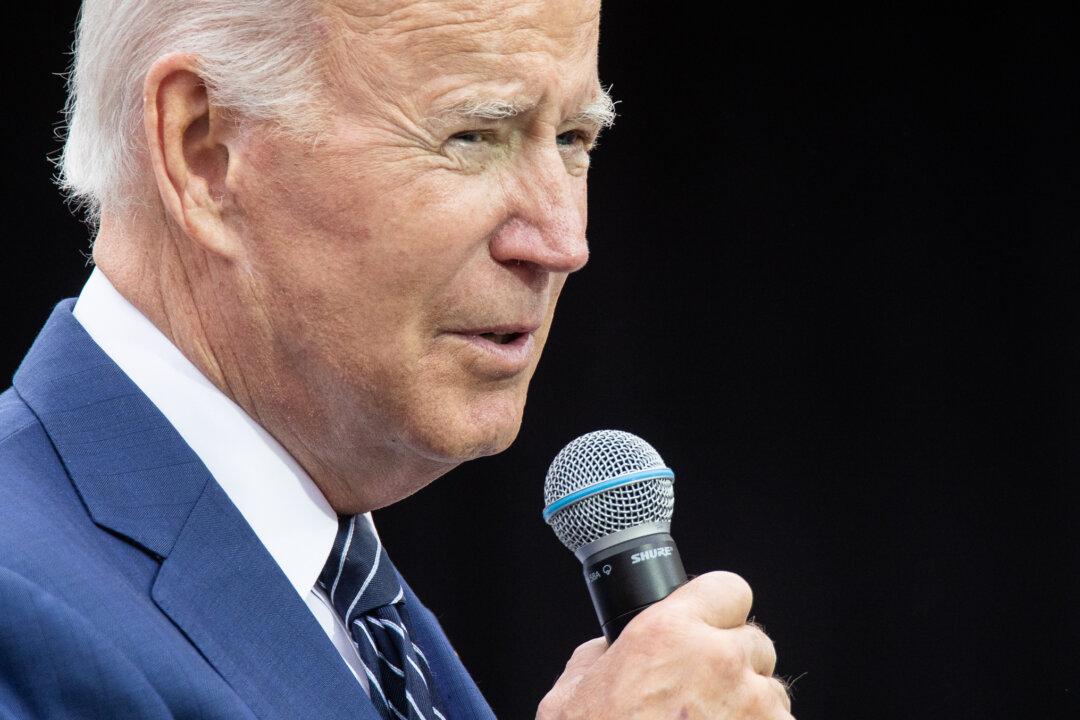

President Joe Biden has called on Congress to give his administration the authority to bar top executives of failed banks from working in the banking sector again.

The White House on March 17 released a plan to hold senior management more accountable when their financial institutions collapse and enter Federal Deposit Insurance Corp. (FDIC) receivership. In addition, the administration urged Congress to make it easier for federal regulators to punish bank executives when they engage in mismanagement and take excessive risks.