Commentary

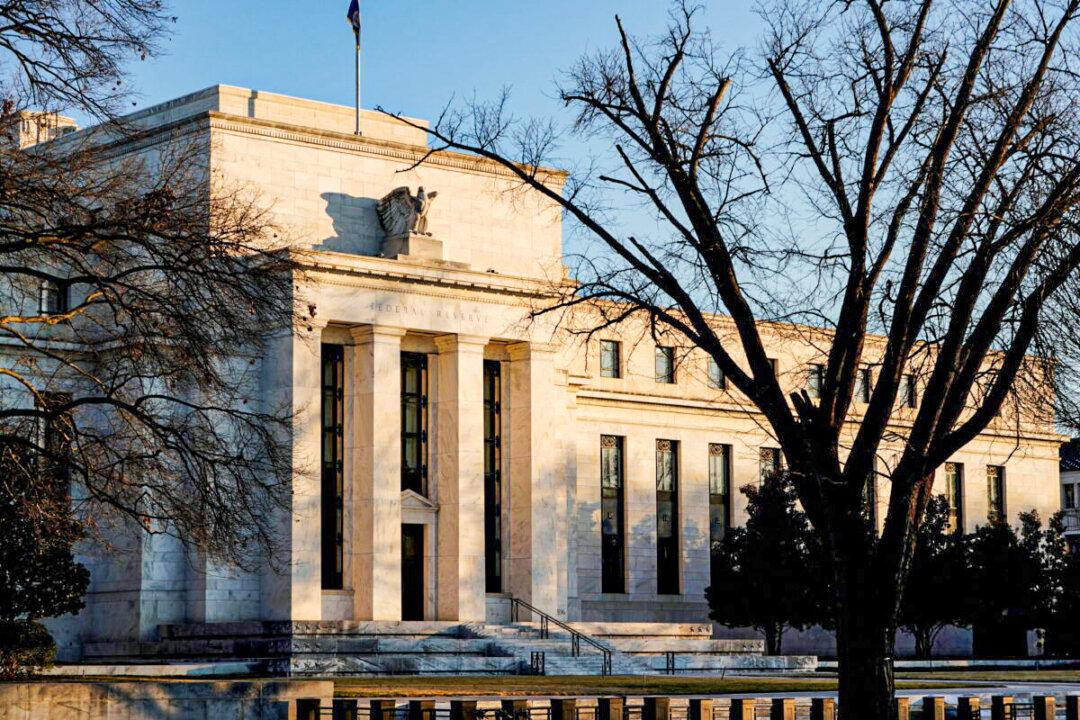

On Dec. 15, Federal Reserve Chairman Jerome Powell announced a doubling of the central bank’s balance sheet taper. While this decision was largely anticipated by the markets, as Powell recently testified before Congress that the policy-setting Federal Open Market Committee would likely end its taper a few months early, the chairman seemed a bit nervous.