Commentary

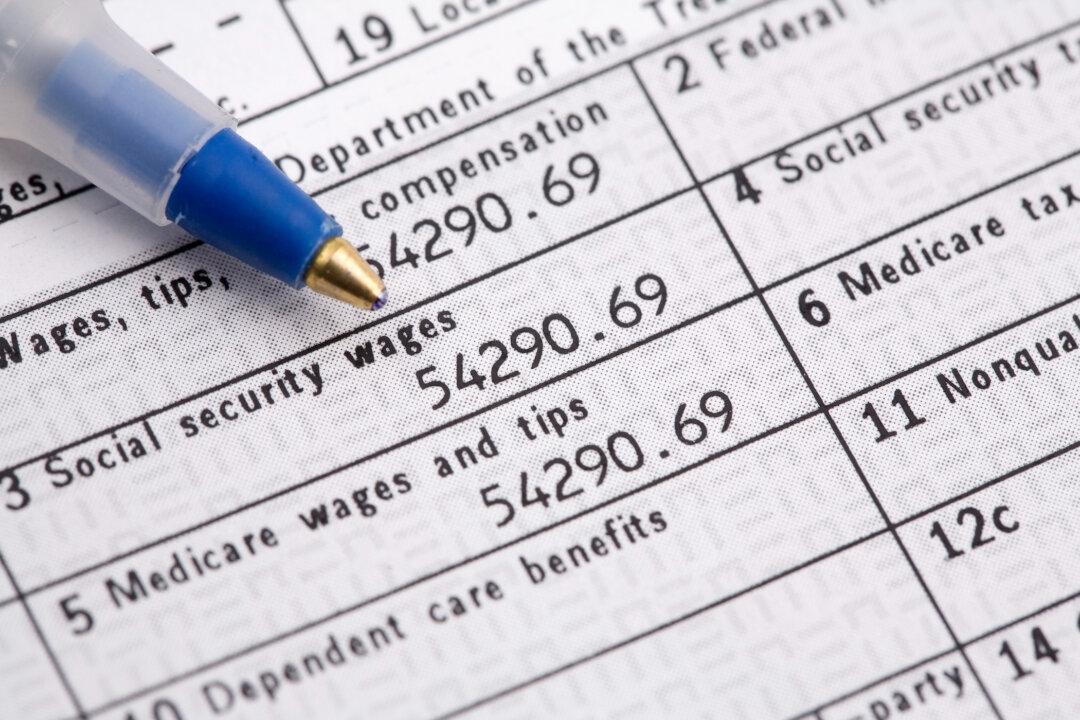

Marc Fasteau and Bay Area author Ian Fletcher’s new book “Industrial Policy for the United States” (2024) is so well written that it has you believing. Until you realize there is not a single reference, even in the index, to the world’s great economists, all of whom said nations should not have an industrial policy: Adam Smith (1776), F.A. Hayek (Nobel), and Milton Friedman (Nobel).