Commentary

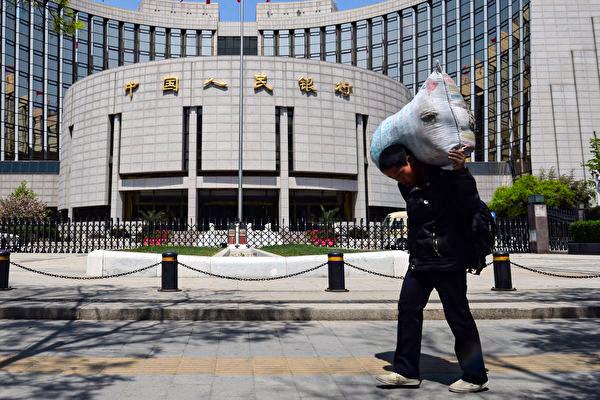

Despite the endless stream of happy talk on China’s economy from state-run Chinese media, the communists are mortgaging their country’s future through incompetence and economic mismanagement.

Despite the endless stream of happy talk on China’s economy from state-run Chinese media, the communists are mortgaging their country’s future through incompetence and economic mismanagement.