Commentary

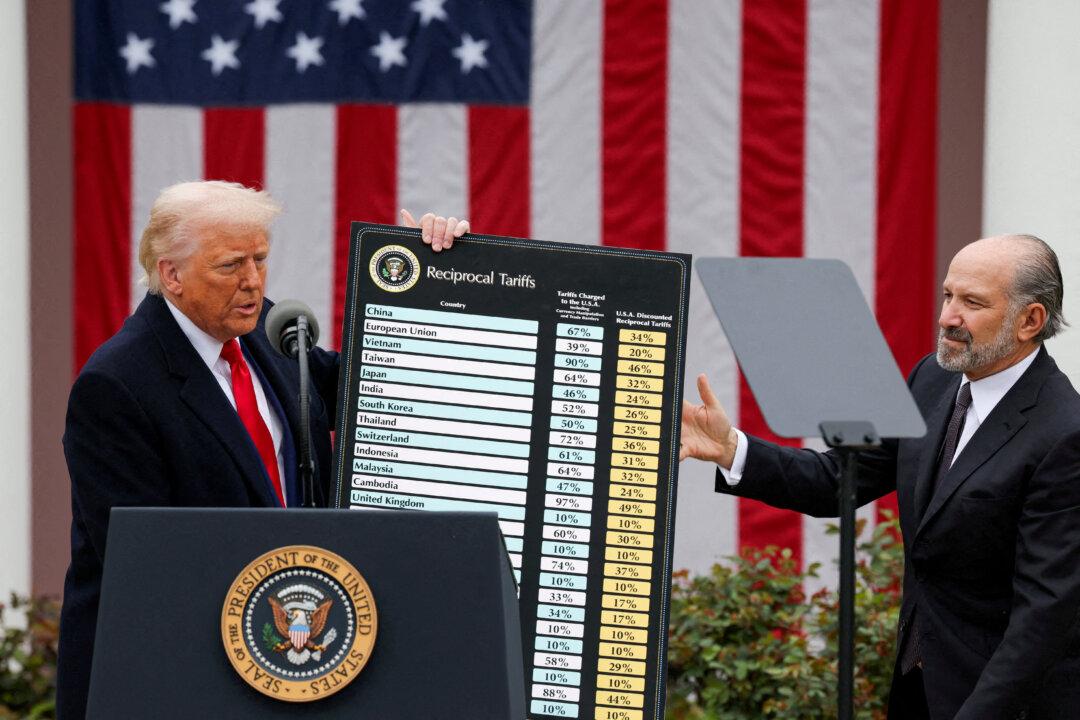

There’s never a dull moment in the Trump administration, as there has been a pause in tariffs on Canada and Mexico as they negotiate specific issues to remain on good terms. Now, it appears that the Trump administration is turning its focus to Asia, specifically China and, to a lesser degree, Taiwan.