Commentary

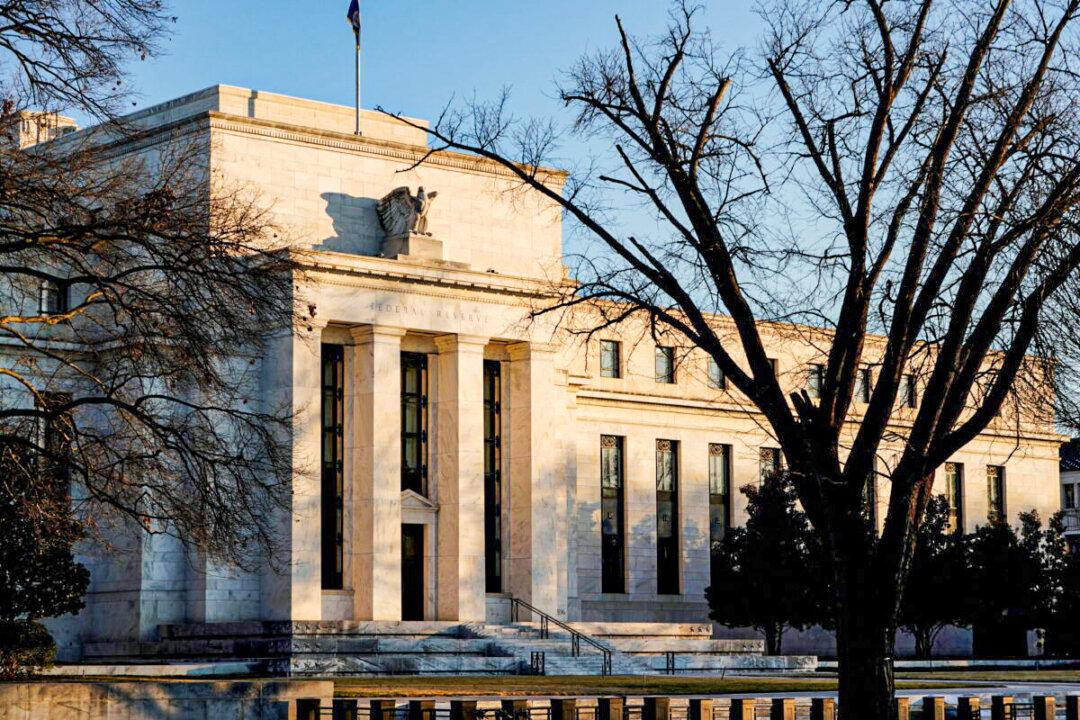

While the world is focused on the situation between Russia and Ukraine, the global economy is already rapidly slowing. Further uncertainty because of geopolitics and war could easily tip the global economy into a recession. For the Federal Reserve, the Russia and Ukraine conflict couldn’t come at a worse time, as the central bank is about to embark on its first tightening cycle since 2004.