Commentary

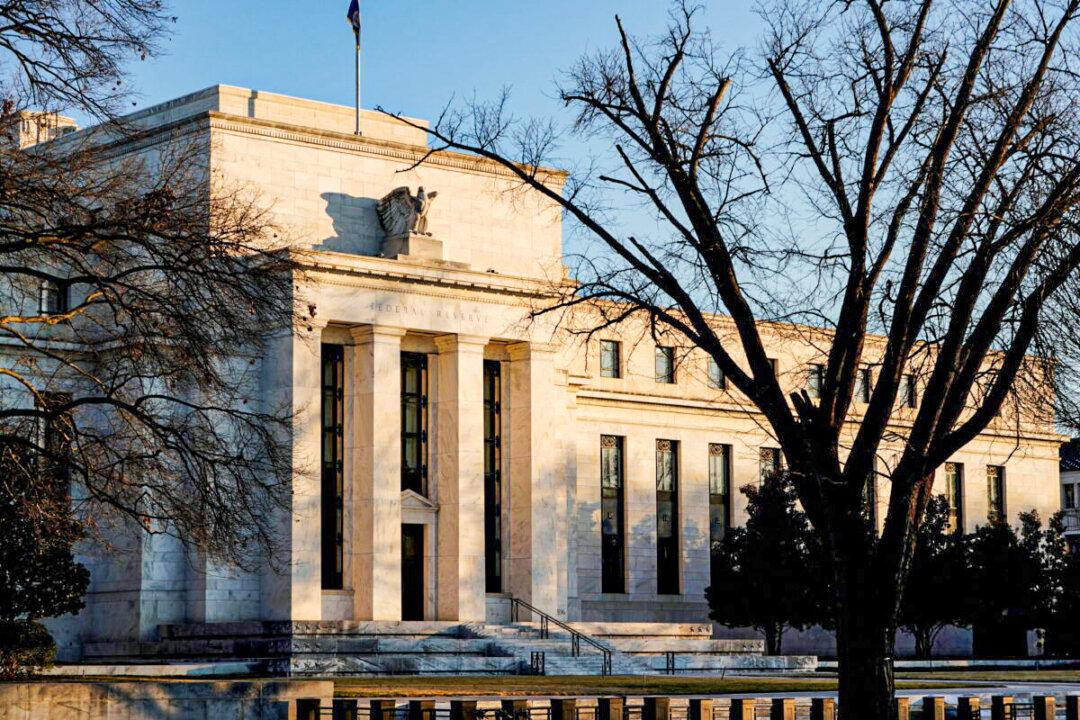

The announcement of a balance sheet taper sent equity buyers into overdrive as they aggressively bought every dip in stocks regardless of the news flow. The relentless bid has propelled stocks to new all-time highs without any regard to the next round of tapering from the Federal Reserve coming mid-January. While the Fed has never reduced its balance sheet by $30 billion in one move, the Bulls look to history to support their risk-taking behavior.