Commentary

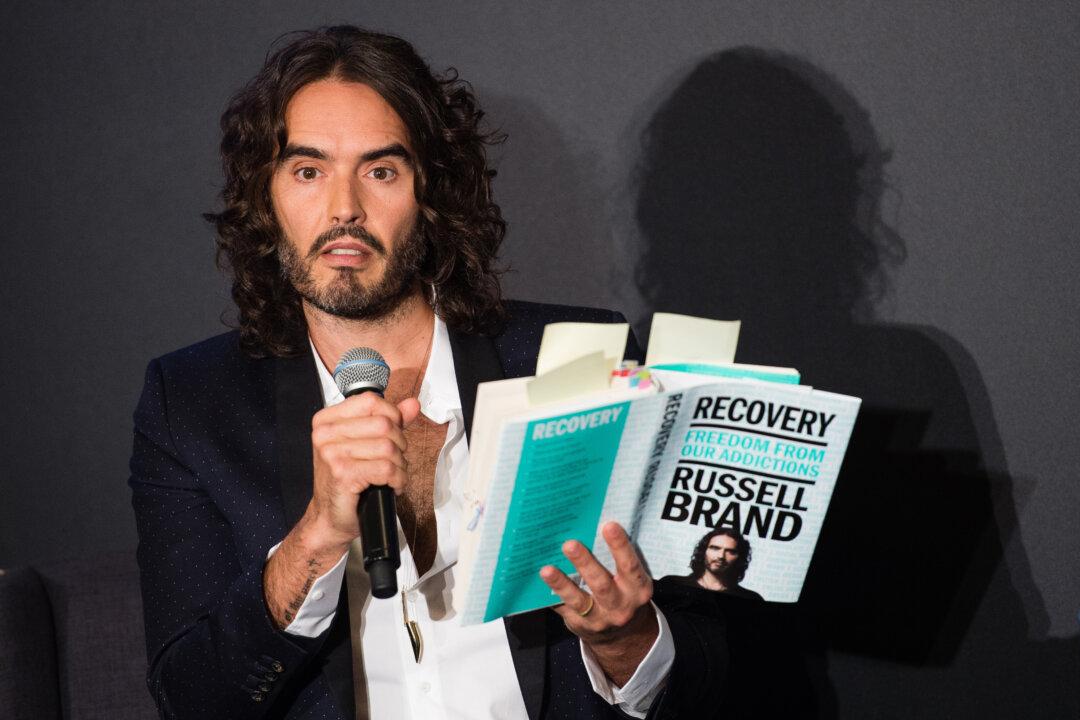

YouTube initiated a ban on commentator Russell Brand on Sept. 19 that prohibits the celebrity from making money on its platform following accusations of sexual assault against the British comedian.

YouTube initiated a ban on commentator Russell Brand on Sept. 19 that prohibits the celebrity from making money on its platform following accusations of sexual assault against the British comedian.