Commentary

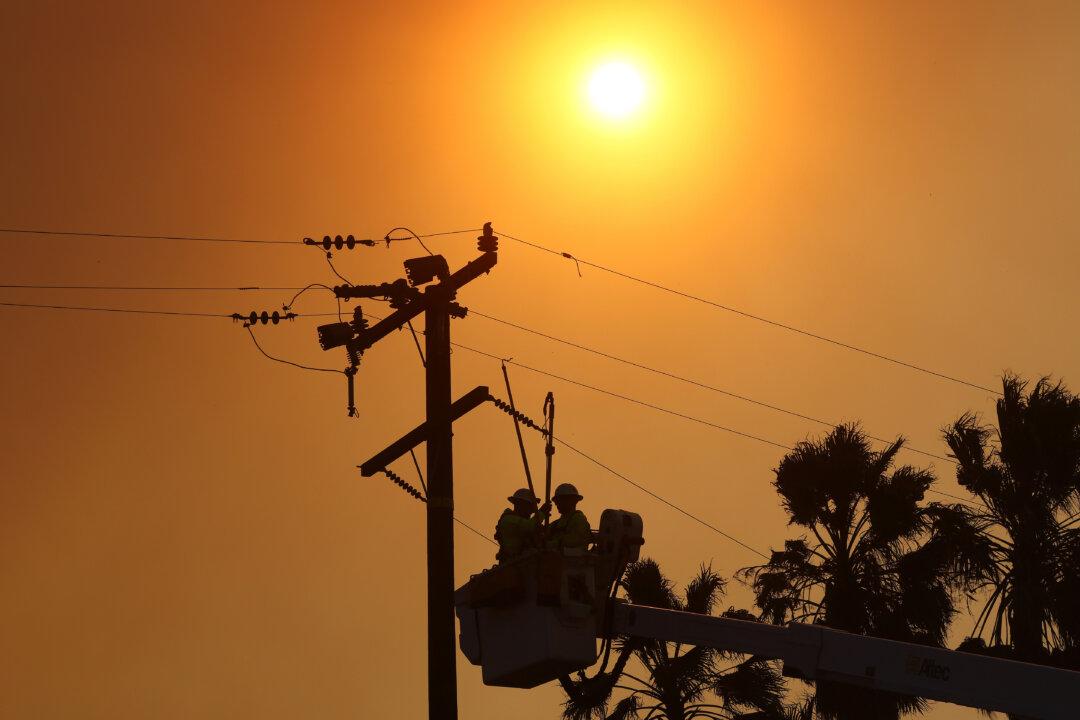

Orange County Power Authority recently launched into business amid promises that it would provide an adequate supply of electric power to its customers in southern California. Now it turns out that OCPA’s claim was premature, putting the region’s electric reliability in jeopardy. OCPA’s tenuous preparedness is only undermined by recent infighting within the agency’s executive suite.