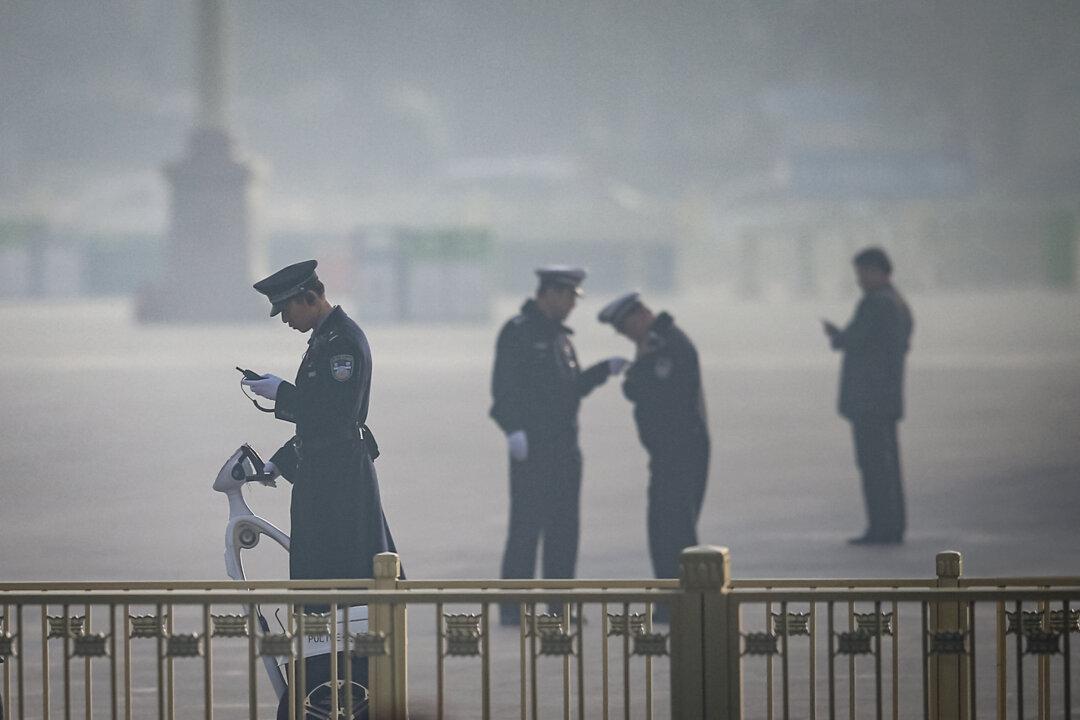

During a recent episode of NTD’s “Pinnacle View,” experts dissected the alarming economic conditions in China, focusing on the collapse of the real estate sector.

Initial hopes for a swift post-COVID-19-pandemic recovery have led to a deepening economic downturn, especially pronounced in major cities such as Guangzhou, Shenzhen, Shanghai, and Beijing, over the past few months.