Commentary

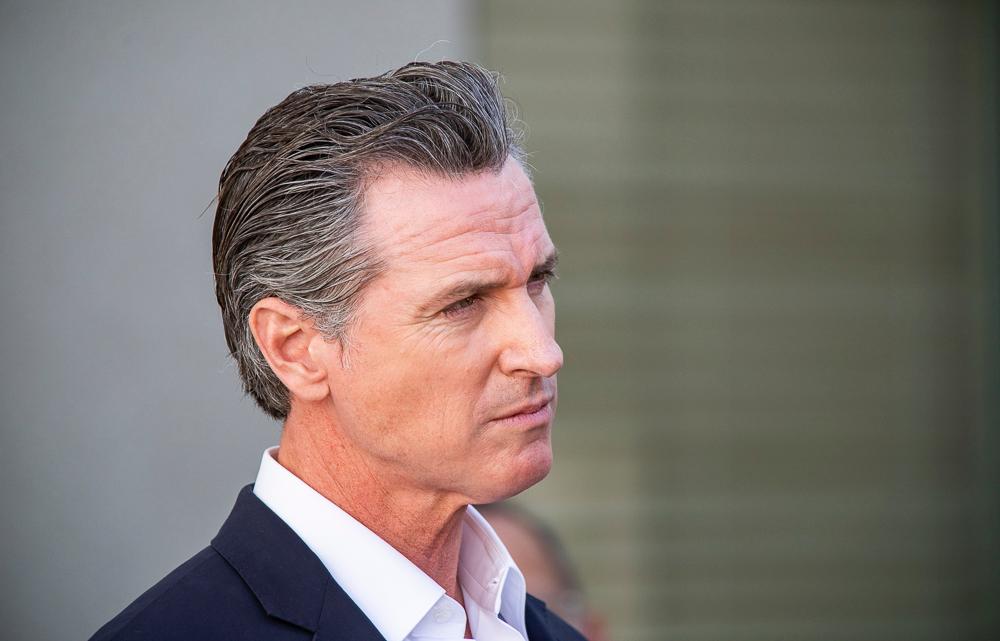

Gov. Gavin Newsom’s new budget proposal (pdf) for fiscal year 2023-24, which begins on July 1, is more a wish list than an actual budget proposal. It projects $297 billion in spending, but also anticipates a $22.5 billion deficit unless certain programs are cut or delayed.