Commentary

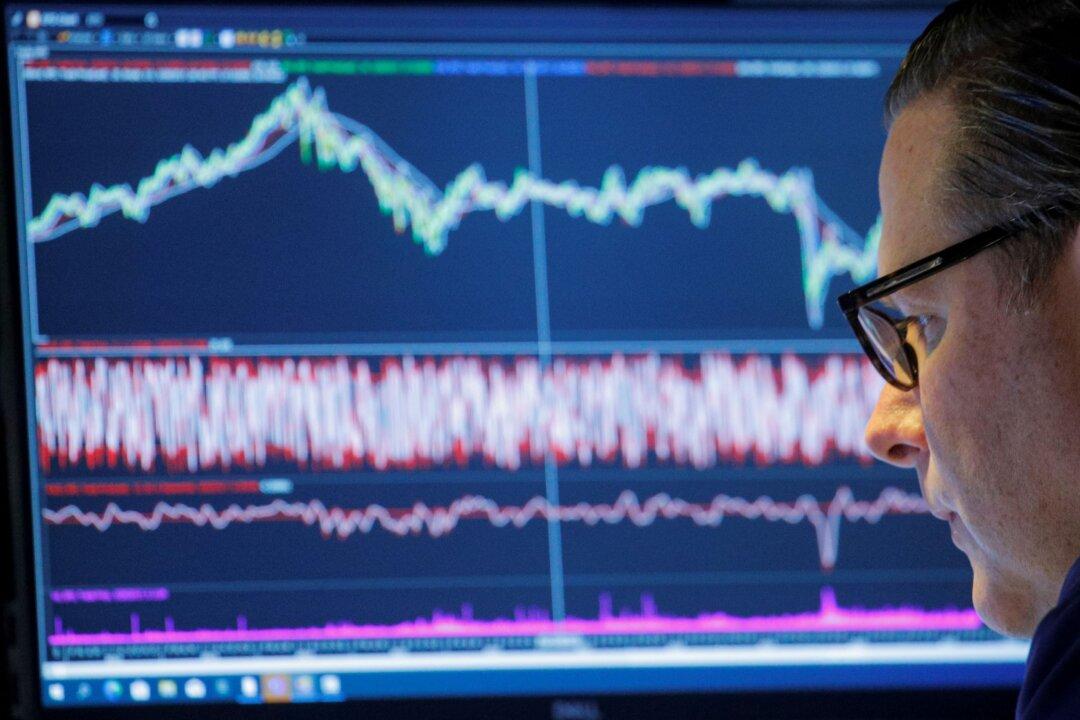

Retail investors continue to eagerly buy every dip or decline in stocks in hopes that stock prices will soon make new all-time highs. While they’re throwing money at stocks, they can’t see the warning signs that financial conditions are tightening. When financial conditions become too tight, risk assets tend to crash.