News Analysis

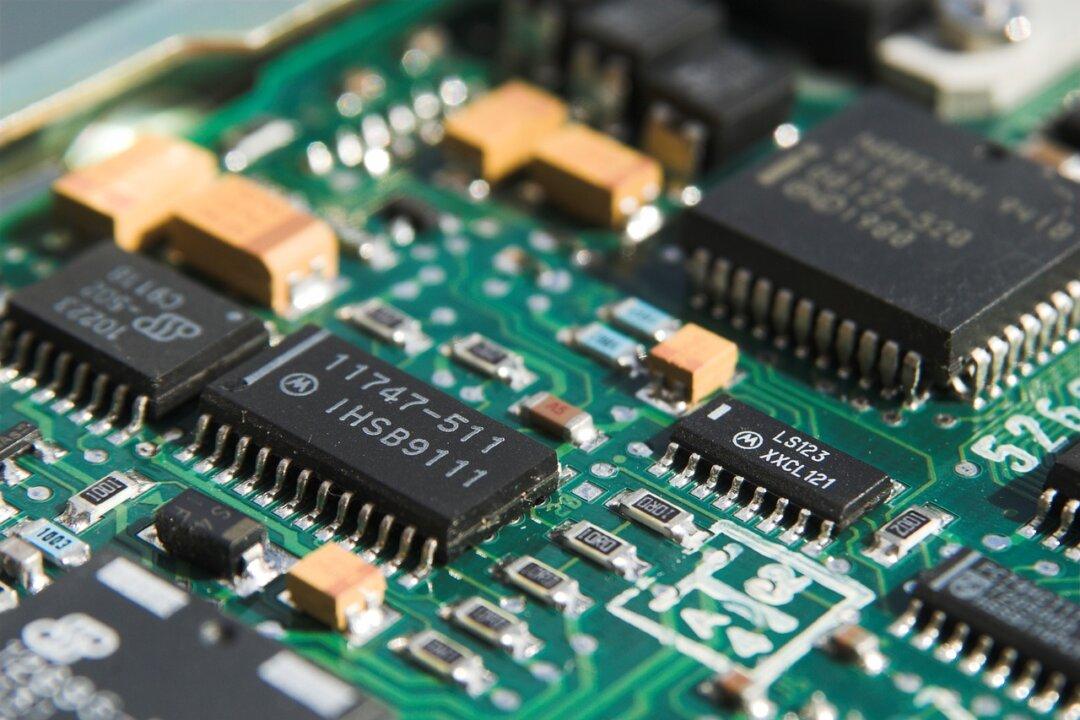

The Chinese Communist Party (CCP) would not have likely secured its self-reliance in chipmaking without support from Taiwanese professionals, amid U.S.–China tech tensions. However, the recent exit of three influential Taiwanese executives from China’s largest chipmaker or its board of directors highlights a reality—that Beijing does not trust them and deems them as “outsiders.”