Commentary

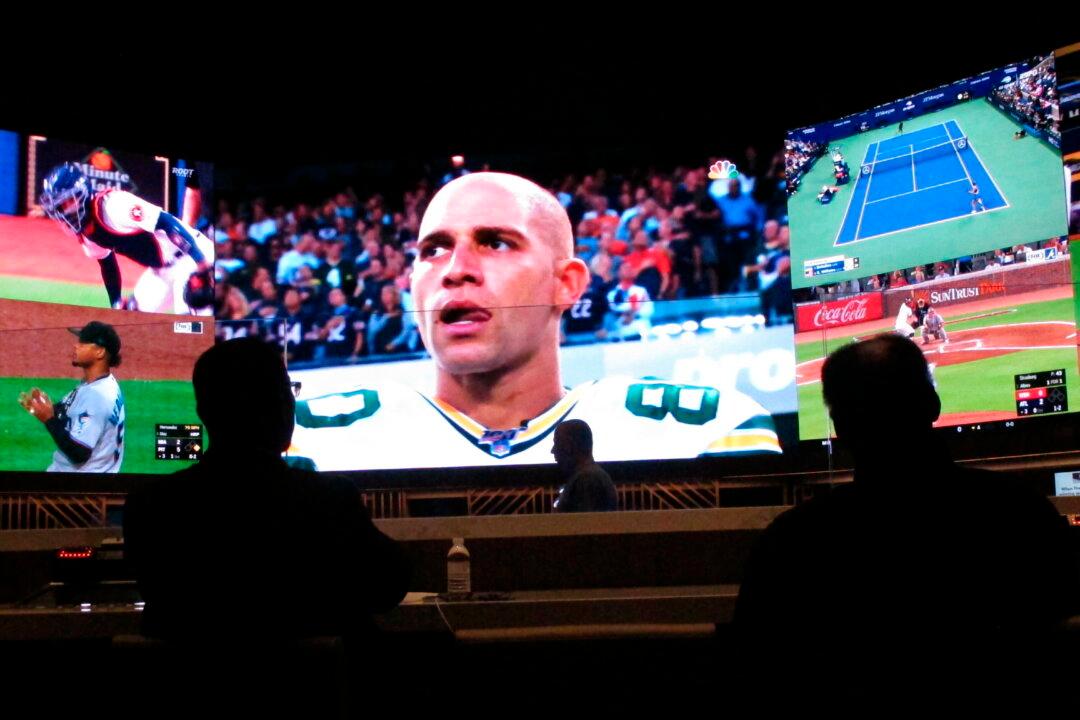

It’s illegal in California to bet on sports events. That illegality extends both to bets in person and bets on the internet.

It’s illegal in California to bet on sports events. That illegality extends both to bets in person and bets on the internet.