Commentary

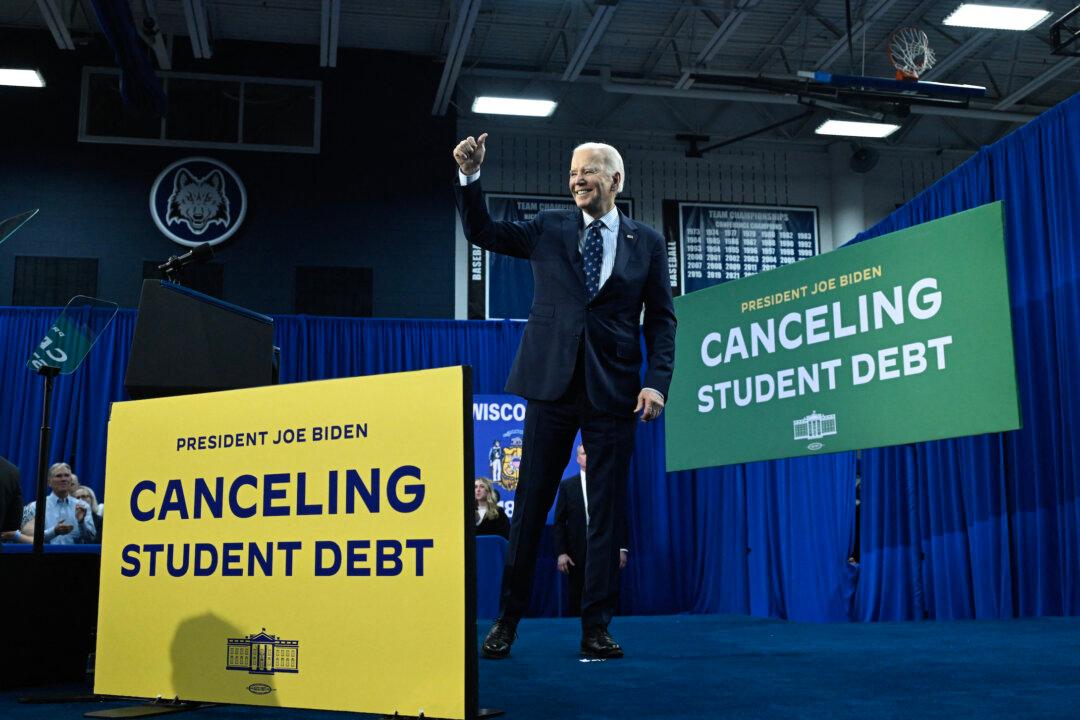

If you’re confused about President Joe Biden’s various student loan debt-cancellation schemes, who can blame you? And on Tuesday, the Biden administration unveiled its third attempt to make you pay for someone else’s life choices.

If you’re confused about President Joe Biden’s various student loan debt-cancellation schemes, who can blame you? And on Tuesday, the Biden administration unveiled its third attempt to make you pay for someone else’s life choices.