Commentary

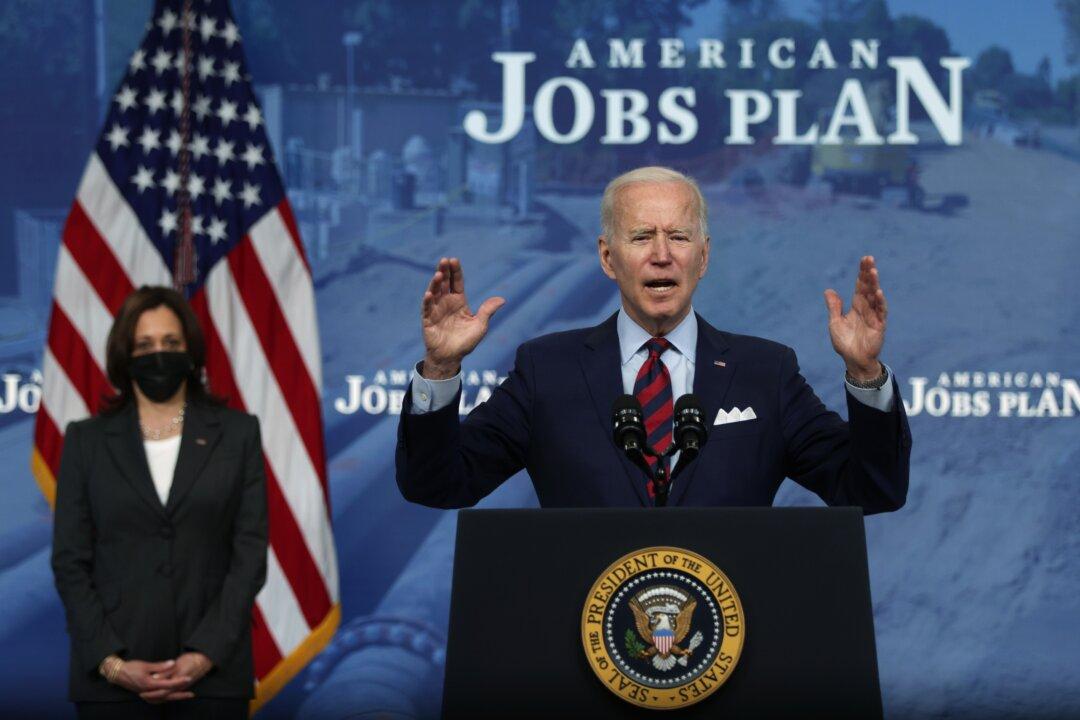

President Joe Biden is in the midst of a media blitz to garner support for his so-called infrastructure plan, the American Jobs Plan.

President Joe Biden is in the midst of a media blitz to garner support for his so-called infrastructure plan, the American Jobs Plan.