Commentary

Apple is America’s most valuable company by market capitalization. But it has major problems in China. That likely factored into the decision by Warren Buffett’s massively successful investing group, Berkshire Hathaway, to sell more than $80 billion worth of Apple shares in the second quarter.

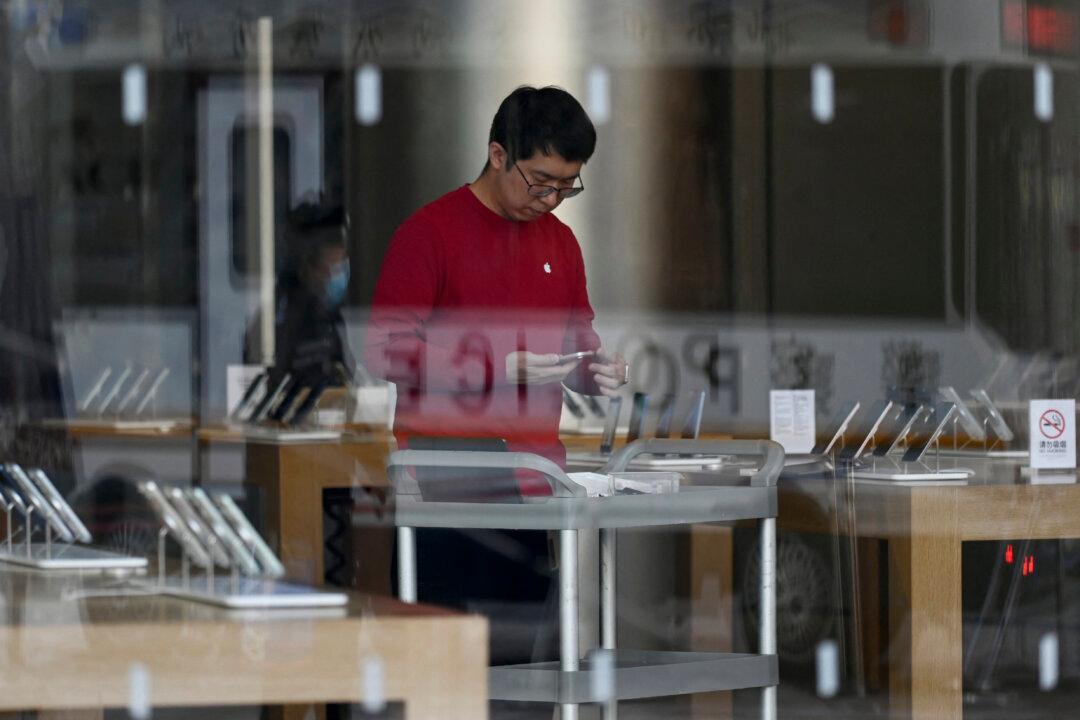

Apple’s iPhone sales dropped precipitously in China over the past year, as local telecom companies Huawei, Xiaomi, Vivo, Oppo, and Honor took the lead among 1.4 billion price-conscious and patriotic Chinese consumers. While Apple is selling its Vision Pro in China and other Asian markets, the Apple wearable has also seen lackluster sales.

Apple sales in China have declined for the past four quarters, with the latest decline at a whopping 6.5 percent and the previous quarter’s decline at an even worse 8.1 percent. Declines are registering even as Apple offered its iPhones at steep discounts of as much as $300 or more over the recent quarter. Apple is now sixth place in smartphone sales in China, with only 14 percent of the market share.

Much of Berkshire’s investments in Chinese companies, including the electric vehicle maker BYD, for example, are based at least in part on hopes of massive growth in coming quarters. So, Apple’s market share losses in China at the same time as U.S. market excitement about the company’s upcoming AI rollout are likely seen by Berkshire as the moment to “get while the getting’s good.”

Apple is running into Chinese headwinds that will likely increase over time because of mounting geopolitical competition with the United States. The Chinese Communist Party (CCP) banned Apple from regime use in September, after which the company lost about $200 billion in market capitalization. Outside of the regime, there is rampant propaganda online that buying a cheaper Chinese smartphone in China is a sign of patriotism or support for the CCP. Sticking to the old and expensive iPhone brand is now portrayed as a continued sell-out to the West, according to some Chinese netizens.

Others have shown outrage, amplified by the regime’s state-controlled media, at the smallest slights. For example, a male Apple employee who sported a single pigtail on the company’s website caused an uproar among China’s netizens. The pigtail, or queue, can be interpreted as an affront to China, given its association with the Manchus, who forced it upon Han males during the Qing imperial era.

The CCP, now that it has absorbed most of what it can from Apple in terms of smartphone technology and manufacturing processes, is increasingly tough on the company. That has led to conflict, including by Chinese tech competitors that are no longer held back by the CCP.

In April, Apple—perhaps unwisely from a shareholder perspective—showed its displeasure with the CCP when it was forced to remove several apps from the Apple store, including Meta’s Threads and WhatsApp, as well as two apps from other companies—Signal and Telegram. More recently, Apple tussled with two Chinese internet giants—Bytedance and Tencent—over their alleged failure to follow app store rules by allowing the diversion of users to non-Apple payment apps.

Contending with the CCP and major companies in China run by the CCP is a risky game to play from Apple’s milquetoast headquarters in Cupertino, California. That adds to the risk that likely led the risk-averse Berkshire Hathaway to dump so many Apple shares.

Amid Apple’s problems in China, where it makes 20 percent of its iPhone sales, its third-quarter global sales were better than expected. They grew at 4.9 percent, driven by increased iPad and Mac sales, as well as its services such as Apple Pay, Apple Store, and TV+. Apple’s planned incorporation of AI into future phones as “Apple Intelligence” starting this fall was well-received by investors and will likely lead to a much-needed sales bump with the iPhone 16 release in September.

Apple also could recoup its losses in China by producing and selling more in India, where it currently sells just 4 percent of its iPhones. However, Apple has reportedly had production problems in India and likely will be competing with cheaper local models there as well. The iPhone 15 Pro sells for $1,550 in India, about $550 more than in the United States. Few can afford it, though the massive market means Apple sells more iPhones in India than in any European country.

Apple’s stumbling in China is a canary in a coal mine to which international investors should pay increasing attention. Foreign success in China requires technology transfers, new local entrants, and greater official and nonofficial resistance. Communists lack respect for property and will discover ways to take market share in their country, by hook or by crook, and at the drop of a hat.

As upsides are truncated in the China market by ideological barriers to U.S. success, so should the current and expected valuations of U.S. companies that do too much business in the world’s most powerful communist country. The moral of the story is to invest in countries with democratic values—or expect to get burned in the end.