Commentary

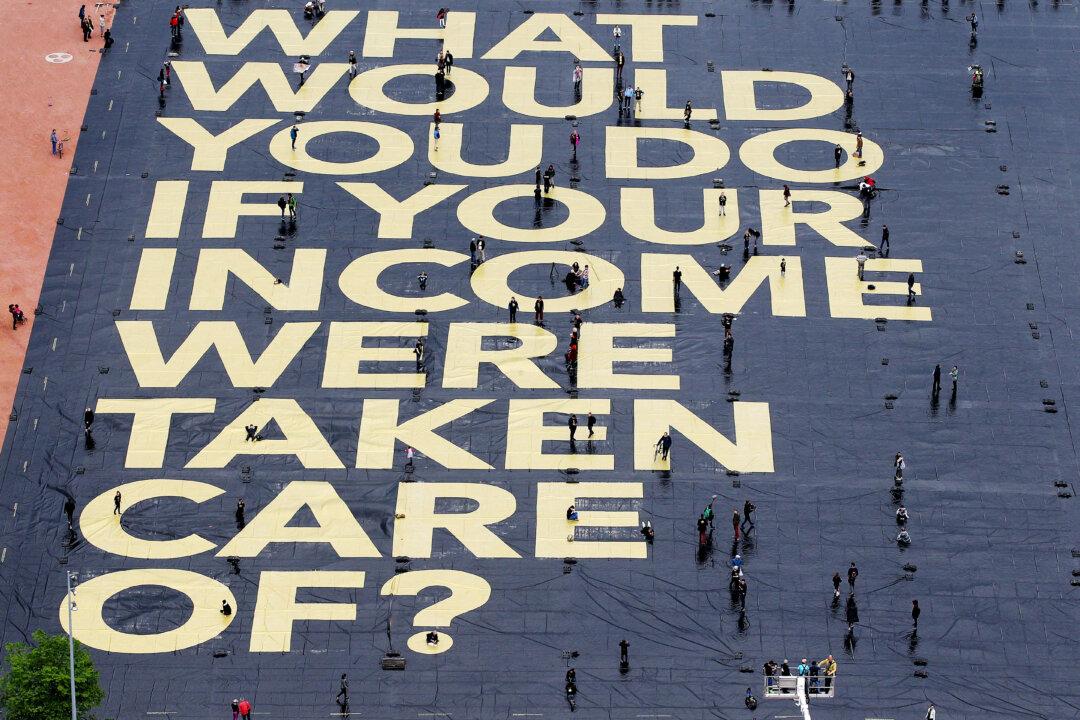

In October 2024, I reported on the release of the largest research project ever on universal basic income (UBI). The study’s results were disappointing for advocates of the idea. In short, the research showed that many people who received the income reduced their hours working and increased leisure time. Furthermore, people didn’t use their leisure time in any of the productive activities advocates often claim (e.g., self-improvement, entrepreneurship, time with family).